Your Buffett indicator 2020 mining are ready in this website. Buffett indicator 2020 are a exchange that is most popular and liked by everyone now. You can Download the Buffett indicator 2020 files here. Download all royalty-free mining.

If you’re searching for buffett indicator 2020 pictures information related to the buffett indicator 2020 interest, you have come to the ideal blog. Our website always gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

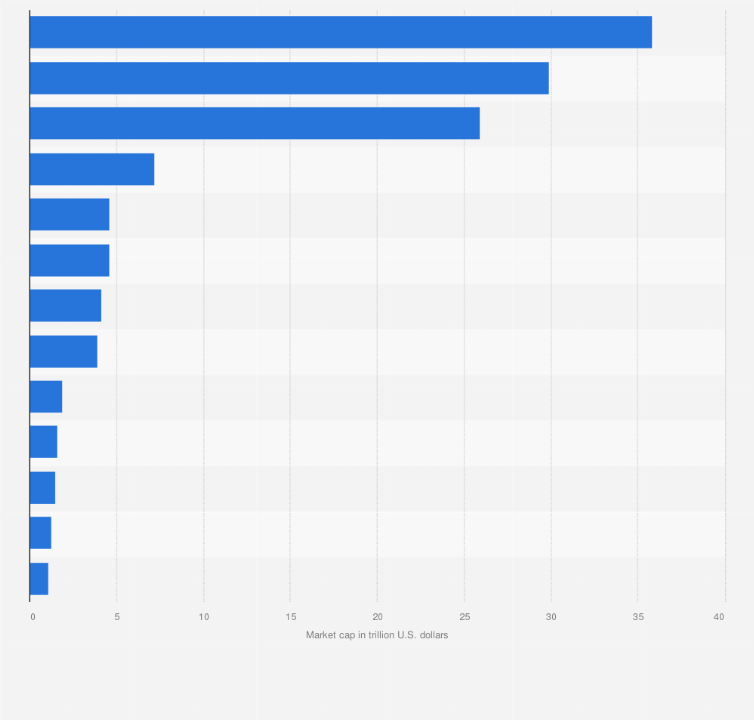

Buffett Indicator 2020. The Buffett Indicator is the ratio of total US stock market valuation to GDP. By the end of 2020 GuruFocus introduced a new indicator total market cap TMC relative to GDP plus Total. As the stock market set records in the final quarter last year the indicator rose 14 in one quarter. Originally a favorite valuation indicator of Warren Buffett.

Pin By Ed Trujillo On Invest In 2021 Nasdaq 100 Nasdaq Investing From pinterest.com

Pin By Ed Trujillo On Invest In 2021 Nasdaq 100 Nasdaq Investing From pinterest.com

And corporate earnings growth is flat. As of January 21 2020 currently the stock market is s ignificantly overvalued as measured by the Buffett Indicator. The four valuation indicators we track in our monthly valuation overview offer a long-term perspective of well over a. Worries about this ratio are overblown. And this measure is the ratio of total market capitalization TMC to gross national product GNP. Since we published the market valuation and implied future return based on the percentage of total market cap TMC relative to the US.

Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment Market Cap to GDP is commonly defined as a measure of the total.

Over the past four decades the TMC-GNP ratio has varied widely. But thats not whats happening. Buffett has since walked back those comments hesitating to endorse any single measure as either comprehensive or. However given that corporations derive their revenue from economic activity the Buffett Indicator suggests investors may be walking into a trap. For instance the Buffett Indicator hit its low point early in 1990s recessionjust like 2020s. The stock market is not the economy Such has been the Sirens Song of investors over the last couple of years as valuation expansion has been the sole driver of the markets performance.

Source: pinterest.com

Source: pinterest.com

The four valuation indicators we track in our monthly valuation overview offer a long-term perspective of well over a. It considers the combined market caps of publicly traded equities worldwide and divides it by the. At the end of 2020 Berkshire Hathaway had a stock portfolio worth 280 billion up from 248 billion the year prior. On the first day of trading in 2020 the Buffett indicator charted an ominous high of 153 according to Wilshire data. As of 2021-11-20 030504 PM CST updates daily.

Source: pinterest.com

Source: pinterest.com

The indicator now at 170 is a warning signal to investors of high stock valuations compared to. The four valuation indicators we track in our monthly valuation overview offer a long-term perspective of well over a. This is what Id do now. Many investors including Warren Buffet calculate the Value of a stock market as a whole to determine whether stocks are currently cheap or expensive. Meanwhile based on the historical ratio of newly introduced total market cap over GDP plus Total.

Source: in.pinterest.com

Source: in.pinterest.com

The Buffett indicator is modestly overvalued at 131 and above 134 is significantly overvalued. Anna Sokolidou Monday 24th August 2020. Market Cap to GDP is a long-term valuation indicator that has become popular in recent years thanks to Warren Buffett. At the end of 2020 Berkshire Hathaway had a stock portfolio worth 280 billion up from 248 billion the year prior. This ratio has rocketed to new all-time highs indicating nosebleed valuation conditions for the stock market.

Source: pinterest.com

Source: pinterest.com

Buffett indicator suggests a stock market crash is coming. The stock market is not the economy Such has been the Sirens Song of investors over the last couple of years as valuation expansion has been the sole driver of the markets performance. The Buffett Indicator is a model which follows Warren Buffetts value investing principles. Market Cap to GDP is a long-term valuation indicator that has become popular in recent years thanks to Warren Buffett. Others call it the Buffett yardstick instead.

Source: pinterest.com

Source: pinterest.com

Buffett has since walked back those comments hesitating to endorse any single measure as either comprehensive or. This is what Id do now. Warren Buffett has called one specific measure probably the best single measure of where valuations stand at any given moment. Giuseppe Sandro Mela. The Buffett Indicator 25072020 You may have heard of investors talking about stock markets as overvalued or undervalued.

Source: pinterest.com

Source: pinterest.com

At the end of 2020 Berkshire Hathaway had a stock portfolio worth 280 billion up from 248 billion the year prior. The four valuation indicators we track in our monthly valuation overview offer a long-term perspective of well over a. Giuseppe Sandro Mela. The Buffett Indicator is a market valuation measure also known as the s tock market capitalization to Gross Domestic Product ratio. The stock market is not the economy Such has been the Sirens Song of investors over the last couple of years as valuation expansion has been the sole driver of the markets performance.

Source: in.pinterest.com

Source: in.pinterest.com

But thats not whats happening. Buffetts Favorite Market Indicator. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment. 558T 229T 243 By our calculation that is currently 95 or about 31 standard deviations above the historical average suggesting that the market is Strongly OvervaluedThese are historical all-time highs. The Stock Market is Significantly Overvalued according to Buffett Indicator.

Source: pinterest.com

Source: pinterest.com

The four valuation indicators we track in our monthly valuation overview offer a long-term perspective of well over a. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment. Posted by Cam Hui - December 26 2020. The Buffett Indicator 25072020 You may have heard of investors talking about stock markets as overvalued or undervalued. The Buffett indicator is modestly overvalued at 131 and above 134 is significantly overvalued.

Source: ar.pinterest.com

Source: ar.pinterest.com

Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment. Giuseppe Sandro Mela. Warren Buffett has 128. The Buffett Indicator is a model which follows Warren Buffetts value investing principles. The four valuation indicators we track in our monthly valuation overview offer a long-term perspective of well over a.

Source: in.pinterest.com

Source: in.pinterest.com

It originated in a December 2001 interview with Carol Loomis where Warren Buffett discussed his favorite way to quantify stock valuation on a macro level. The Stock Market is Significantly Overvalued according to Buffett Indicator. Market Cap to GDP is a long-term valuation indicator that has become popular in recent years thanks to Warren Buffett. Buffett indicator suggests a stock market crash is coming. However given that corporations derive their revenue from economic activity the Buffett Indicator suggests investors may be walking into a trap.

Source: pinterest.com

Source: pinterest.com

At the end of 2020 Berkshire Hathaway had a stock portfolio worth 280 billion up from 248 billion the year prior. There has been some recent hand wringing over Warren Buffetts so-called favorite indicator the market cap to GDP ratio. Buffett indicator suggests a stock market crash is coming. At the end of 2020 Berkshire Hathaway had a stock portfolio worth 280 billion up from 248 billion the year prior. Market Cap to GDP is a long-term valuation indicator for stocks.

Source: in.pinterest.com

Source: in.pinterest.com

It had rebounded significantly by the recessions end and kept climbing irregularly through 2000s peak. For instance the Buffett Indicator hit its low point early in 1990s recessionjust like 2020s. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment Market Cap to GDP is commonly defined as a measure of the total. Giuseppe Sandro Mela. Buffett has since walked back those comments hesitating to endorse any single measure as either comprehensive or.

Source: pinterest.com

Source: pinterest.com

Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment. Meanwhile based on the historical ratio of newly introduced total market cap over GDP plus Total. Many investors including Warren Buffet calculate the Value of a stock market as a whole to determine whether stocks are currently cheap or expensive. However given that corporations derive their revenue from economic activity the Buffett Indicator suggests investors may be walking into a trap. The indicator now at 170 is a warning signal to investors of high stock valuations compared to.

Source: pinterest.com

Source: pinterest.com

Meanwhile based on the historical ratio of newly introduced total market cap over GDP plus Total. It originated in a December 2001 interview with Carol Loomis where Warren Buffett discussed his favorite way to quantify stock valuation on a macro level. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment. The Buffett indicator is modestly overvalued at 131 and above 134 is significantly overvalued. The Stock Market is Significantly Overvalued according to Buffett Indicator.

Source: in.pinterest.com

Source: in.pinterest.com

Debunking the Buffett Indicator. Over the past four decades the TMC-GNP ratio has varied widely. Others call it the Buffett yardstick instead. The ratio of the total value of the US stock market vs current GDP. Based on the historical ratio of total market cap over GDP currently at 2097 it is likely to return -33 a year from this level of valuation including dividends.

Source: pinterest.com

Source: pinterest.com

Buffett has since walked back those comments hesitating to endorse any single measure as either comprehensive or. As of November 11 2021 we calculate the Buffett Indicator as 215 which is about 24 standard deviations above the historical average suggesting that the US stock market is Strongly Overvalued. The ratio of the total value of the US stock market vs current GDP. The indicator now at 170 is a warning signal to investors of high stock valuations compared to. Warren Buffett has 128.

Source: pinterest.com

Source: pinterest.com

The US stock market is firmly in fire territory with a current Buffett indicator reading of 208. As of November 11 2021 we calculate the Buffett Indicator as 215 which is about 24 standard deviations above the historical average suggesting that the US stock market is Strongly Overvalued. Since we published the market valuation and implied future return based on the percentage of total market cap TMC relative to the US. This is what Id do now. Giuseppe Sandro Mela.

Source: pinterest.com

Source: pinterest.com

As of January 21 2020 currently the stock market is s ignificantly overvalued as measured by the Buffett Indicator. 558T 229T 243 By our calculation that is currently 95 or about 31 standard deviations above the historical average suggesting that the market is Strongly OvervaluedThese are historical all-time highs. This ratio has rocketed to new all-time highs indicating nosebleed valuation conditions for the stock market. On the first day of trading in 2020 the Buffett indicator charted an ominous high of 153 according to Wilshire data. Since we published the market valuation and implied future return based on the percentage of total market cap TMC relative to the US.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title buffett indicator 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.