Your Example of high risk low return investment news are ready. Example of high risk low return investment are a coin that is most popular and liked by everyone now. You can Download the Example of high risk low return investment files here. News all royalty-free trading.

If you’re looking for example of high risk low return investment pictures information connected with to the example of high risk low return investment interest, you have visit the right blog. Our website frequently gives you suggestions for seeking the highest quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

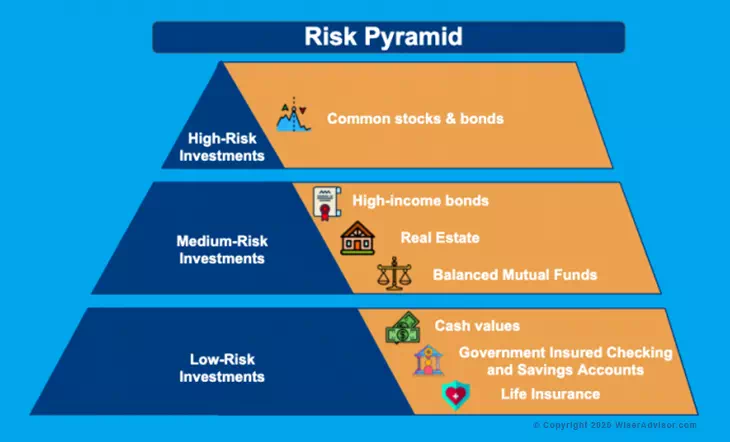

Example Of High Risk Low Return Investment. High Interest Savings Accounts With high-interest savings account you can earn nominal amount of interest on the deposit in your savings account. When one formulates an investment plan this risk-return trade-off is an important consideration. Here is a list of 7 low-risk investments with respectable returns. Putting aside the risks to individual asset classes the bigger risk to investors is shortfall risk.

High Risk Investments Definition Examples Top 6 High Risk Investment From wallstreetmojo.com

High Risk Investments Definition Examples Top 6 High Risk Investment From wallstreetmojo.com

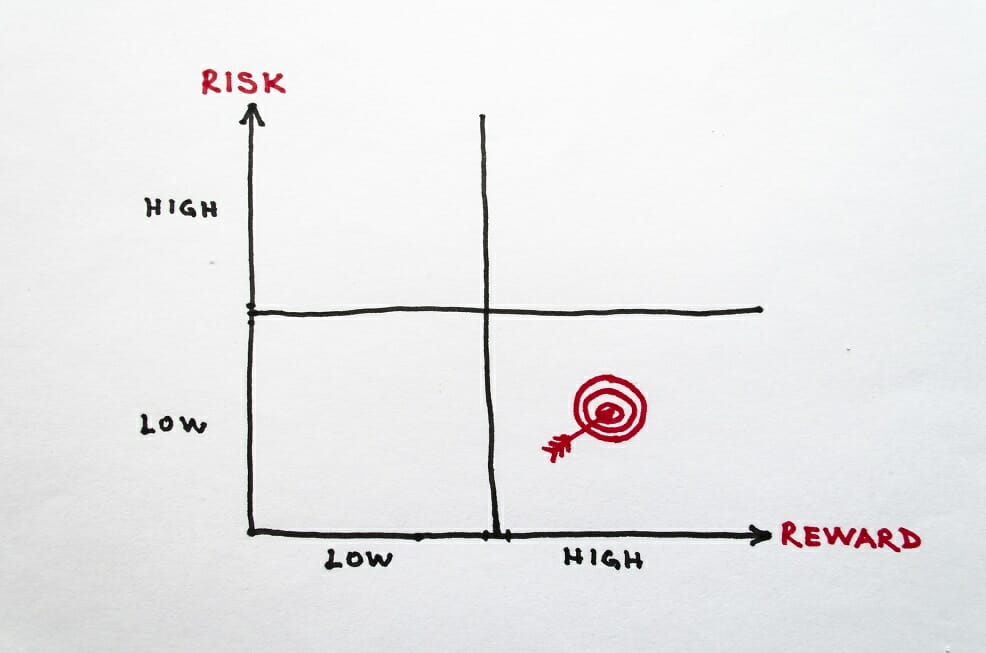

World investors with a high exposure to equities and bonds most balanced funds run the risk of not. High School High Risk Investment High Return Investment Low Risk Investment Low Return Investment This is an example of. High Interest Savings Accounts With high-interest savings account you can earn nominal amount of interest on the deposit in your savings account. In that case my favorites are cryptocurrencies penny stocks and binary options. In other words stretched valuations and subsequent low prospective returns means that the typical diversified or balanced portfolio that relies largely on a relatively large and static allocation to equities will likely deliver returns to investors that are well short of their target. Monte Carlo Simulation 1 See answer msiedlecki31 is waiting for your help.

High risk low return.

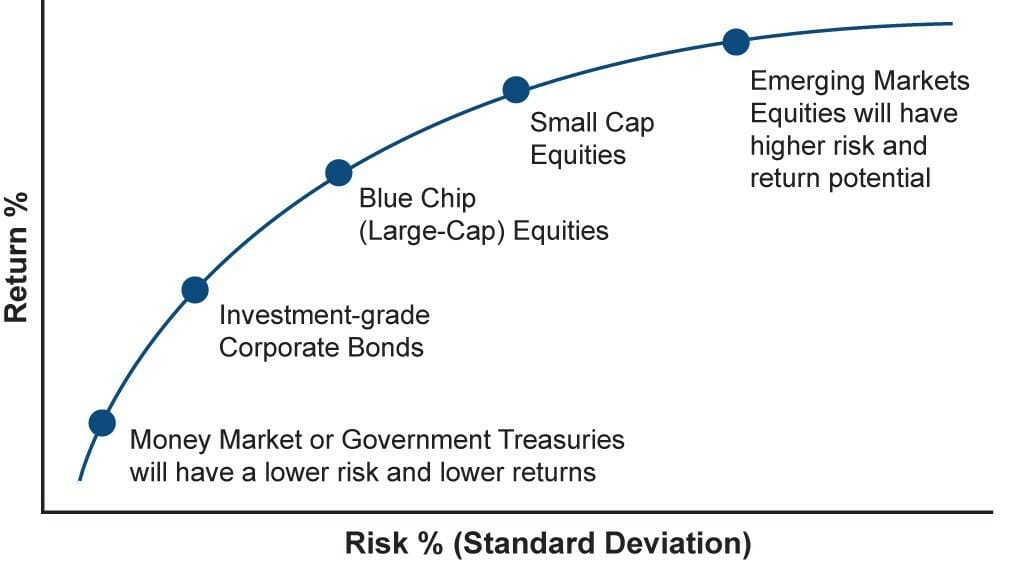

Efficient Market Theory b. Investments which carry low risks such as high grade bonds will offer a lower expected rate of return than those which carry high risk such as common stock of a new unproven company. In other words stretched valuations and subsequent low prospective returns means that the typical diversified or balanced portfolio that relies largely on a relatively large and static allocation to equities will likely deliver returns to investors that are well short of their target. Different types of risks include project-specific risk industry-specific risk competitive risk international risk and market risk. And some low risk low return options are index funds mutual funds and bonds. Low risk DOES High Return.

Finding a low risk in business or investment is essentially the same. Efficient Market Theory b. Medium risk investments are more long-term investments with moderate returns usually of around 5-12. A medium risk investor often diversifies their investments by investing in a range of things while still trying to maximise returns. I once worked for a start up that sold telecommunications equipment to Telco carriers.

Source: docplayer.net

Source: docplayer.net

Alan Moreira and Tyler Muir at Yale University point out that investment strategies that reduce equity risk when expected volatility is high would have beaten the US market for years. Sample again is the 14 advanced countries and the graph shows year effects. Risk and return are what investing is all about. Bad investments are viewed as risky with poor returns. I once worked for a start up that sold telecommunications equipment to Telco carriers.

Source: investopedia.com

Source: investopedia.com

When one formulates an investment plan this risk-return trade-off is an important consideration. Add your answer and earn points. In investing risk and return are highly correlated. And some low risk low return options are index funds mutual funds and bonds. Putting aside the risks to individual asset classes the bigger risk to investors is shortfall risk.

Source: investopedia.com

Source: investopedia.com

Increased potential returns on investment usually go hand-in-hand with increased risk. A good investment has the characteristics of high return and low risk. Putting aside the risks to individual asset classes the bigger risk to investors is shortfall risk. This startup was the middle man between different manufacturers and the customer. World investors with a high exposure to equities and bonds most balanced funds run the risk of not.

Source: wiseradvisor.com

Source: wiseradvisor.com

Finding a low risk in business or investment is essentially the same. Consider an experiment done by Statman et al. When one formulates an investment plan this risk-return trade-off is an important consideration. For example investing in foreign emerging markets is a textbook example of high-risk investments. While many high-risk high-return investments might yield great returns due to the luck of the draw other high-risk investments by their nature offer the possibility of either great loss or great gain.

Source: pinterest.com

Source: pinterest.com

Investments which carry low risks such as high grade bonds will offer a lower expected rate of return than those which carry high risk such as common stock of a new unproven company. In other words stretched valuations and subsequent low prospective returns means that the typical diversified or balanced portfolio that relies largely on a relatively large and static allocation to equities will likely deliver returns to investors that are well short of their target. I once worked for a start up that sold telecommunications equipment to Telco carriers. For example investing in foreign emerging markets is a textbook example of high-risk investments. While many high-risk high-return investments might yield great returns due to the luck of the draw other high-risk investments by their nature offer the possibility of either great loss or great gain.

Source: proprofs.com

Source: proprofs.com

Low risk DOES High Return. The higher risk an investment is the higher return its going to be and the opposite is true too. Medium risk investments are more long-term investments with moderate returns usually of around 5-12. In other words stretched valuations and subsequent low prospective returns means that the typical diversified or balanced portfolio that relies largely on a relatively large and static allocation to equities will likely deliver returns to investors that are well short of their target. Putting aside the risks to individual asset classes the bigger risk to investors is shortfall risk.

Source: investopedia.com

Source: investopedia.com

Finding a low risk in business or investment is essentially the same. When one formulates an investment plan this risk-return trade-off is an important consideration. Investments which carry low risks such as high grade bonds will offer a lower expected rate of return than those which carry high risk such as common stock of a new unproven company. In investing risk and return are highly correlated. These might include shares bonds property or stocks that are good for long term investment.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

3 Low-Risk Investments. Sample again is the 14 advanced countries and the graph shows year effects. And some low risk low return options are index funds mutual funds and bonds. Using the firms. A high-yield savings account is a federally insured investing vehicle that offers a decent rate of return per year without any meaningful risks.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

High School High Risk Investment High Return Investment Low Risk Investment Low Return Investment This is an example of. High Interest Savings Accounts With high-interest savings account you can earn nominal amount of interest on the deposit in your savings account. The higher risk an investment is the higher return its going to be and the opposite is true too. Bad investments are viewed as risky with poor returns. World investors with a high exposure to equities and bonds most balanced funds run the risk of not.

Source: investopedia.com

Source: investopedia.com

Investors can therefore better make money by cutting risk than by increasing it. And some low risk low return options are index funds mutual funds and bonds. Low risk DOES High Return. For example investing in foreign emerging markets is a textbook example of high-risk investments. Efficient Market Theory b.

Source: pinterest.com

Source: pinterest.com

This startup was the middle man between different manufacturers and the customer. Putting aside the risks to individual asset classes the bigger risk to investors is shortfall risk. Investing in low-risk options is a great way to maintain a balanced portfolio. And some low risk low return options are index funds mutual funds and bonds. High Interest Savings Accounts With high-interest savings account you can earn nominal amount of interest on the deposit in your savings account.

Source: slideplayer.com

Source: slideplayer.com

Increased potential returns on investment usually go hand-in-hand with increased risk. A medium risk investor often diversifies their investments by investing in a range of things while still trying to maximise returns. Bad investments are viewed as risky with poor returns. Increased potential returns on investment usually go hand-in-hand with increased risk. Medium risk investments are more long-term investments with moderate returns usually of around 5-12.

Source: java366.wordpress.com

Source: java366.wordpress.com

High Interest Savings Accounts With high-interest savings account you can earn nominal amount of interest on the deposit in your savings account. The higher risk an investment is the higher return its going to be and the opposite is true too. Monte Carlo Simulation 1 See answer msiedlecki31 is waiting for your help. Increased potential returns on investment usually go hand-in-hand with increased risk. While many high-risk high-return investments might yield great returns due to the luck of the draw other high-risk investments by their nature offer the possibility of either great loss or great gain.

Source: investopedia.com

Source: investopedia.com

Below are 3 choices to consider if you value predictability and security. Alan Moreira and Tyler Muir at Yale University point out that investment strategies that reduce equity risk when expected volatility is high would have beaten the US market for years. While many high-risk high-return investments might yield great returns due to the luck of the draw other high-risk investments by their nature offer the possibility of either great loss or great gain. These might include shares bonds property or stocks that are good for long term investment. 3 Low-Risk Investments.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

3 Low-Risk Investments. High risk low return. Below are 3 choices to consider if you value predictability and security. This startup was the middle man between different manufacturers and the customer. Alan Moreira and Tyler Muir at Yale University point out that investment strategies that reduce equity risk when expected volatility is high would have beaten the US market for years.

Source: investopedia.com

Source: investopedia.com

World investors with a high exposure to equities and bonds most balanced funds run the risk of not. High risk low return. Sample again is the 14 advanced countries and the graph shows year effects. And the higher the risk the higher the possible returns is a fundamental tenet when evaluating potential investment options. Efficient Market Theory b.

Source: wattfinancialsolutions.co.uk

Source: wattfinancialsolutions.co.uk

For example investing in foreign emerging markets is a textbook example of high-risk investments. Investors can therefore better make money by cutting risk than by increasing it. The higher risk an investment is the higher return its going to be and the opposite is true too. Finding a low risk in business or investment is essentially the same. Consider an experiment done by Statman et al.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title example of high risk low return investment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.