Your High risk etf asx coin are available in this site. High risk etf asx are a exchange that is most popular and liked by everyone today. You can News the High risk etf asx files here. Download all free news.

If you’re searching for high risk etf asx pictures information linked to the high risk etf asx interest, you have pay a visit to the right blog. Our website always gives you hints for downloading the maximum quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

High Risk Etf Asx. MVW targets a higher return profile and has a potential for higher losses. As has always been an interesting aspect of the Australian market and though this ETF gives investors broad exposure to Australian equities it remains heavily weighted towards financials and materials stocks. Convenient cost-effective exposure to the crypto economy. Relatively high fee of 051 as at 31 August 2021.

Best Etfs Australia Six Park S Proven Investment Strategy From sixpark.com.au

Best Etfs Australia Six Park S Proven Investment Strategy From sixpark.com.au

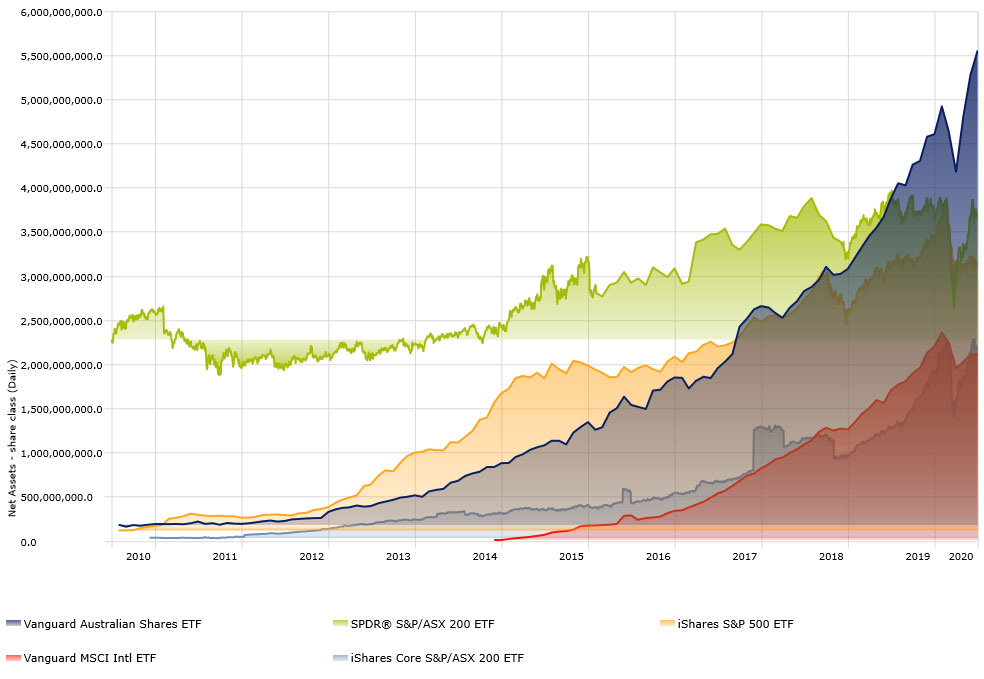

An investment in CRYP should be considered very high risk. CIMIC is a high risk counter trend investment with the prospect of a multi-year recovery once earnings hit an inflection point. Instead of buying shares in one company ETFs allow you to get a basket of shares or assets with a single trade. CRYP provides focused exposure to the crypto economy within the familiar ETF structure. Last year 2019 was a record year for Vanguard ETFs with Vanguard ETF Assets Under Management AUM growing to 195B making 2019 Vanguards strongest year. Meanwhile last years highest performing ETF the BetaShares Asia Technology Fund has above average fees of 067.

Best Australian high dividend ETFs.

Convenient cost-effective exposure to the crypto economy. IShares SPASX High Dividend Yield ETF IHD Russell High Dividend Australian Shares ETF RDV SPDR MSCI Australia Select High Dividend Yield Fund SYI Vanguard Australian Shares High Yield ETF VHY ETFS SPASX 300 High Yield Plus ETF ZYAU VanEck Morningstar Australian Moat Income ETF DVDY. Aggressive Growth ETFs are aimed at providing growth using aggressive tactics meaning they have a high riskreward profile. ASX investors now have the means to gain exposure to a basket of up to 50 assets currently 32 closely linked to a range of cryptos such as. 203 rows ASX ETF List. Relatively high fee of 051 as at 31 August 2021.

Source: marcustoday.com.au

Source: marcustoday.com.au

Long weighted average maturity of over 1326 years as at 31 August 2021. Ad Explore how PitchBook company databases can help you find detailed company information. Therefore high RoI is not expected initially. But it would be the right time to buy Crypto ETF ASX if the price falls drastically. Nations often dependent on performance against USD.

Source: betashares.com.au

Source: betashares.com.au

High risk investment with over 40 of the bonds with a sub investment grade credit rating. BBOZ is a highly volatile Fund and there is no guarantee the ETF will provide effective or perfect protection in a falling market. As has always been an interesting aspect of the Australian market and though this ETF gives investors broad exposure to Australian equities it remains heavily weighted towards financials and materials stocks. This means some of them will be riskier than others. Track deal history stock information cap tables investors executives and more.

Source: pinterest.com

Source: pinterest.com

Instead of buying shares in one company ETFs allow you to get a basket of shares or assets with a single trade. High risk investment with over 40 of the bonds with a sub investment grade credit rating. Meanwhile last years highest performing ETF the BetaShares Asia Technology Fund has above average fees of 067. CRYP provides focused exposure to the crypto economy within the familiar ETF structure. High or very high riskreturn profile and needs daily access to capital.

Source: theconversation.com

Source: theconversation.com

Instead of buying shares in one company ETFs allow you to get a basket of shares or assets with a single trade. Convenient cost-effective exposure to the crypto economy. Investment risk is considered high to very high. Generally the higher the expected return of an investment the higher the risk and the greater the variability of returns. Fund and Issuer Identifiers.

Source: pinterest.com

Source: pinterest.com

Many ETFs aim to replicate the performance of an index like the SPASX 200 in Australia or the SP 500 in the United States or specific assets such as. Long weighted average maturity of over 1326 years as at 31 August 2021. ASX investors now have the means to gain exposure to a basket of up to 50 assets currently 32 closely linked to a range of cryptos such as. Nations often dependent on performance against USD. Click on the tabs below to see more information on Aggressive Growth ETFs including historical performance dividends holdings expense ratios technical indicators analysts reports and more.

Source: thebalance.com

Source: thebalance.com

You can invest in CRYP as simply as buying any share on the ASX. ASX investors now have the means to gain exposure to a basket of up to 50 assets currently 32 closely linked to a range of cryptos such as. 203 rows ASX ETF List. Investment risk is considered high to very high. Nations often dependent on performance against USD.

Source: pinterest.com

Source: pinterest.com

Many ETFs aim to replicate the performance of an index like the SPASX 200 in Australia or the SP 500 in the United States or specific assets such as. Best Australian high dividend ETFs. Please let us know your views about Crypto ETF. IShares SPASX High Dividend Yield ETF IHD Russell High Dividend Australian Shares ETF RDV SPDR MSCI Australia Select High Dividend Yield Fund SYI Vanguard Australian Shares High Yield ETF VHY ETFS SPASX 300 High Yield Plus ETF ZYAU VanEck Morningstar Australian Moat Income ETF DVDY. IVV The first ETF for investors to look at is the iShares SP 500 ETF.

Source: investopedia.com

Source: investopedia.com

MVW targets a higher return profile and has a potential for higher losses. This is a high risk strategy as gains and losses are magnified compared to a simple ETF tracking the ASX 200 Index. Vanguard is the most popular ETF manager in Australia and has been for quite a while. Track deal history stock information cap tables investors executives and more. Meanwhile last years highest performing ETF the BetaShares Asia Technology Fund has above average fees of 067.

Source: bestetfs.com.au

Source: bestetfs.com.au

BetaShares has notified that Crypto ETF ASX should be treated at high risk due to the highly volatile and the possibility of huge price swings in the Australian Stock Exchange. Investment risk is considered high to very high. Aggressive Growth ETFs are aimed at providing growth using aggressive tactics meaning they have a high riskreward profile. 20 best performing exchange traded products in 2021 Fund name. Nations often dependent on performance against USD.

Source: morningstar.com.au

Source: morningstar.com.au

An investment in CRYP should be considered very high risk. This means some of them will be riskier than others. Unlike the other internationally-focused ETFs that we have examined the iShares Core SP ASX 200 ETF gives investors broad exposure to Australias blue-chip index the ASX 200. IShares SP 500 ETF ASX. Long weighted average maturity of over 1326 years as at 31 August 2021.

Source: captainfi.com

Source: captainfi.com

Instead of buying shares in one company ETFs allow you to get a basket of shares or assets with a single trade. Its important to consider how exchange traded funds ETFs fit in to your overall portfolio. Fund and Issuer Identifiers. Below are the 10 highest returning ETPs in Australia including all standard ETFs synthetic ETFs and actively managed ETFs. On this page youll find a comparison of over 200 ETFs listed on the ASX.

Source: pinterest.com

Source: pinterest.com

IShares SPASX High Dividend Yield ETF IHD Russell High Dividend Australian Shares ETF RDV SPDR MSCI Australia Select High Dividend Yield Fund SYI Vanguard Australian Shares High Yield ETF VHY ETFS SPASX 300 High Yield Plus ETF ZYAU VanEck Morningstar Australian Moat Income ETF DVDY. Please let us know your views about Crypto ETF. You can invest in CRYP as simply as buying any share on the ASX. Last year 2019 was a record year for Vanguard ETFs with Vanguard ETF Assets Under Management AUM growing to 195B making 2019 Vanguards strongest year. This means some of them will be riskier than others.

Source: betashares.com.au

Source: betashares.com.au

Generally the higher the expected return of an investment the higher the risk and the greater the variability of returns. But it would be the right time to buy Crypto ETF ASX if the price falls drastically. This is a high risk strategy as gains and losses are magnified compared to a simple ETF tracking the ASX 200 Index. On this page youll find a comparison of over 200 ETFs listed on the ASX. As with any investment ETFs involve risk.

Source: sixpark.com.au

Source: sixpark.com.au

Many ETFs aim to replicate the performance of an index like the SPASX 200 in Australia or the SP 500 in the United States or specific assets such as. Aggressive Growth ETFs are aimed at providing growth using aggressive tactics meaning they have a high riskreward profile. Instead of buying shares in one company ETFs allow you to get a basket of shares or assets with a single trade. Best Australian high dividend ETFs. MVW targets a higher return profile and has a potential for higher losses.

Source: fool.com

Source: fool.com

BetaShares has notified that Crypto ETF ASX should be treated at high risk due to the highly volatile and the possibility of huge price swings in the Australian Stock Exchange. Best Australian high dividend ETFs. Aggressive Growth ETFs are aimed at providing growth using aggressive tactics meaning they have a high riskreward profile. This means some of them will be riskier than others. Therefore MVW is likely to be appropriate for consumers who are higher risk in nature can accept higher potential losses in order to target a higher return or.

Source: captainfi.com

Source: captainfi.com

But it would be the right time to buy Crypto ETF ASX if the price falls drastically. Last year 2019 was a record year for Vanguard ETFs with Vanguard ETF Assets Under Management AUM growing to 195B making 2019 Vanguards strongest year. CIMIC is a high risk counter trend investment with the prospect of a multi-year recovery once earnings hit an inflection point. IShares SP 500 ETF ASX. This is a high risk strategy as gains and losses are magnified compared to a simple ETF tracking the ASX 200 Index.

Source: pinterest.com

Source: pinterest.com

Click on the tabs below to see more information on Aggressive Growth ETFs including historical performance dividends holdings expense ratios technical indicators analysts reports and more. As has always been an interesting aspect of the Australian market and though this ETF gives investors broad exposure to Australian equities it remains heavily weighted towards financials and materials stocks. Meanwhile last years highest performing ETF the BetaShares Asia Technology Fund has above average fees of 067. CIMIC is a high risk counter trend investment with the prospect of a multi-year recovery once earnings hit an inflection point. Ad Explore how PitchBook company databases can help you find detailed company information.

Source: fool.com

Source: fool.com

We look at the management fee the lower the better the funds under management or FUM which shows you how big an ETF is the 1 3 and 5 year returns and the distribution yield a combination of dividends and capital gains. Instead of buying shares in one company ETFs allow you to get a basket of shares or assets with a single trade. Fund and Issuer Identifiers. IShares SPASX High Dividend Yield ETF IHD Russell High Dividend Australian Shares ETF RDV SPDR MSCI Australia Select High Dividend Yield Fund SYI Vanguard Australian Shares High Yield ETF VHY ETFS SPASX 300 High Yield Plus ETF ZYAU VanEck Morningstar Australian Moat Income ETF DVDY. CRYP provides focused exposure to the crypto economy within the familiar ETF structure.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title high risk etf asx by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.