Your High risk isa funds news are available in this site. High risk isa funds are a news that is most popular and liked by everyone this time. You can Get the High risk isa funds files here. Get all royalty-free mining.

If you’re looking for high risk isa funds pictures information linked to the high risk isa funds keyword, you have come to the right blog. Our website always gives you suggestions for refferencing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that match your interests.

High Risk Isa Funds. Those looking for actively managed funds that target highyield bonds could consider Royal London Sterling Extra Yield which currently pays 65pc annual income and. This allows each individual fund to be slightly riskier which helps boost projected returns whilst still controlling the risk of the portfolio overall. The fund has one of the largest and best resourced emerging markets investment teams which are based from London New York and Singapore. Some of the different growth ISAs available include structured growth ISAs fund ISAs and those that invest in emerging markets.

Home Nextadvisor With Time Smart Money Investing Finance From ro.pinterest.com

Home Nextadvisor With Time Smart Money Investing Finance From ro.pinterest.com

These are our best buys for ISAs where you are comfortable with high risk investments. Patrick Connollys Top Five Aggressive Funds. If you open a stocks and shares ISA any profits and dividends are tax free. The managers look for companies which dont have too much borrowing that produce high and stable returns and operate on higher than average margins. Fidelity Best Stocks and Shares ISA for Mutual Fund Investing. Open an ISA Open a Stocks Shares ISA online in minutes.

With just over five weeks to go until ISA deadline day you could be starting to feel slightly overwhelmed by the sheer amount of information out there.

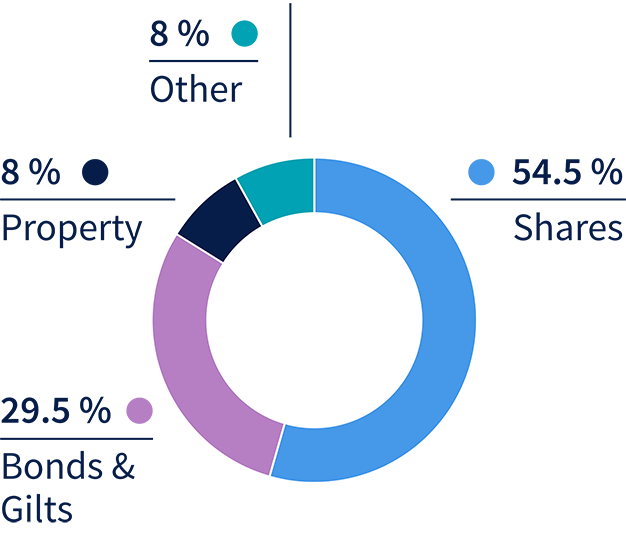

They could for example be firms listed on the Alternative Investment Market AIM or a company that is currently experiencing financial difficulties. The CushonMix portfolio is made up of funds that have a low correlation with each other. If you open a stocks and shares ISA any profits and dividends are tax free. Patrick Connollys Top Five Aggressive Funds. The long term asset mix is made up of 98 Equity and 2 Cash. The fund aims to invest in the best companies in the world.

Source: youinvest.co.uk

Source: youinvest.co.uk

The fund has delivered a 164 return over 12 months. Low to medium to high to very high. Junior ISAs Junior ISAs give you a 9000 annual allowance to invest for the children in your life. The iShares Core FTSE 100 UCITS ETF ISF can also earn extra returns for investors because it lends out securities it owns to short sellers for cash. The fund aims to invest in the best companies in the world.

Source: pinterest.com

Source: pinterest.com

The CushonMix portfolio is made up of funds that have a low correlation with each other. Assets grow at different rates which means your asset allocation may no longer reflect your attitude to risk over time. This fund aims to pay a higher income than many other funds. The fund aims to invest in the best companies in the world. This feature allows you to state from the outset that you want to avoid the most high-risk investment strategies.

Source: pinterest.com

Source: pinterest.com

This is perhaps as close as you can get to a pair of safe hands in what is a volatile investment sector. Patrick Connollys Top Five Aggressive Funds. There is a limit of 20000 you can invest each. A Flexi-ISA allows you to reinvest any withdrawals youve made in the same tax year without losing your allowance. The ISA allowance for the current and upcoming tax year starting on 6 April 2021 is 20000.

Source: in.pinterest.com

Source: in.pinterest.com

Junior ISAs Junior ISAs give you a 9000 annual allowance to invest for the children in your life. Putting your money in an ISA is a tax efficient way to save or invest. Experts reveal their top fund picks. This feature allows you to state from the outset that you want to avoid the most high-risk investment strategies. Some of the different growth ISAs available include structured growth ISAs fund ISAs and those that invest in emerging markets.

Source: natwest.com

Source: natwest.com

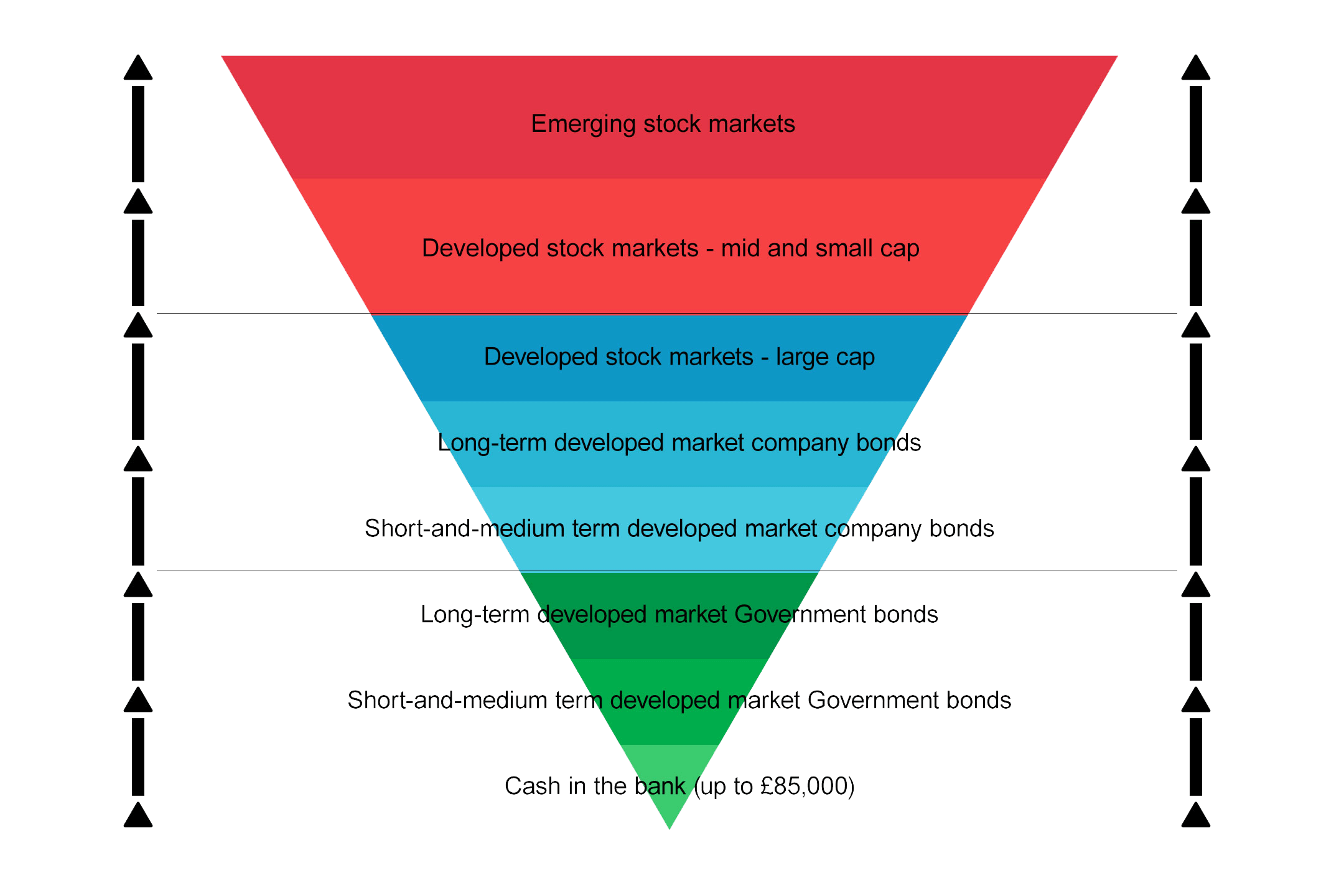

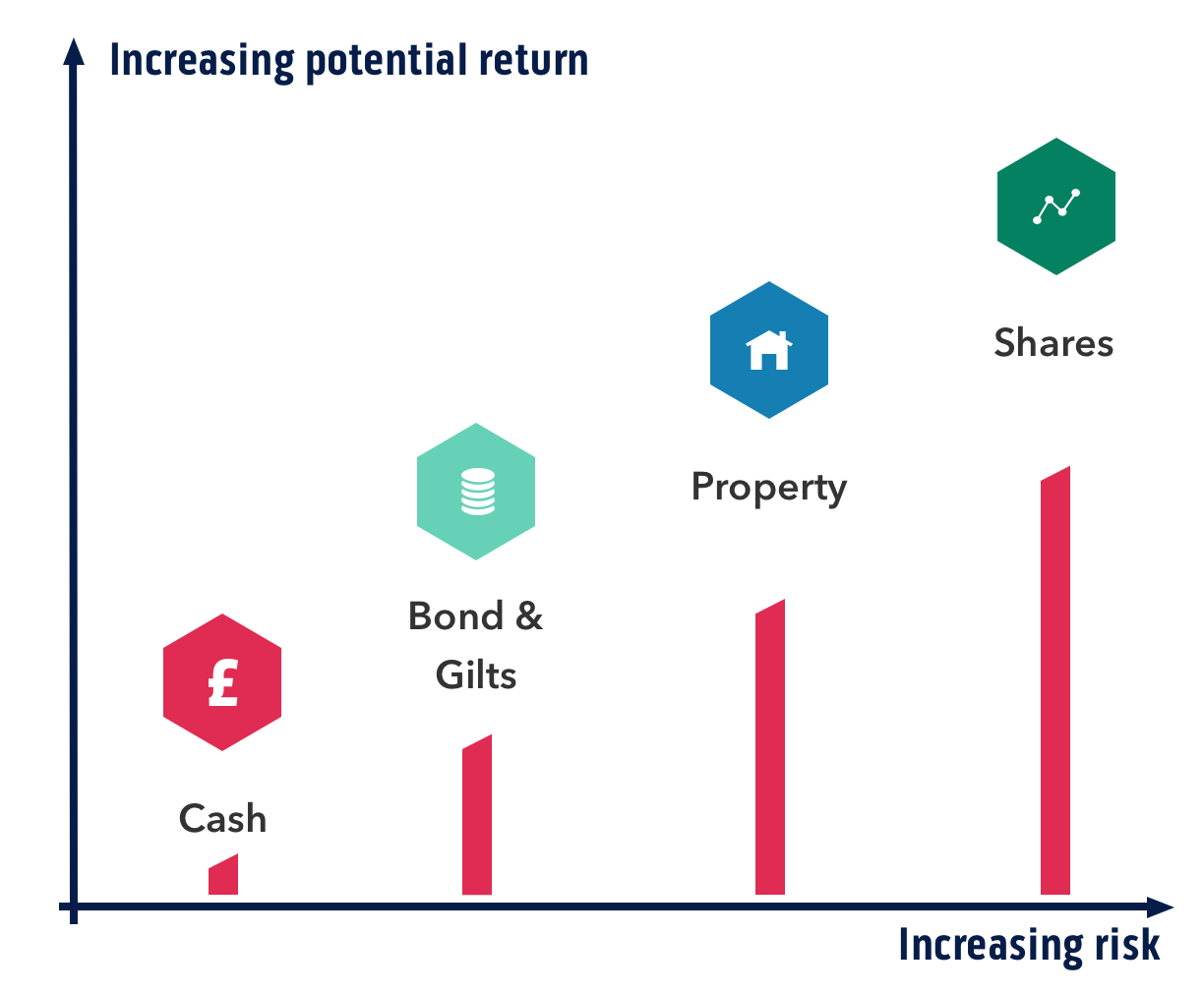

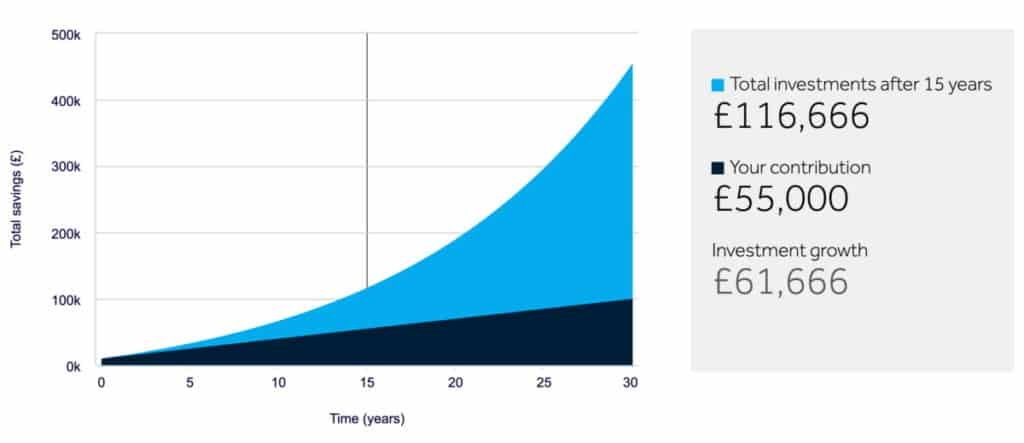

They will be volatile thats not really risk which means that you risk losing say 15 to 25 in a year very rare but they could and do grow 20 to 40 in a year. As the risk profile increases to a high level so does the feasibility of a large return or a larger capital loss. Those looking for actively managed funds that target highyield bonds could consider Royal London Sterling Extra Yield which currently pays 65pc annual income and. ARC TIME Freehold Income Authorised. Hollands also advocates equity income funds specifically those which target companies with good cash flow.

Source: scripbox.com

Source: scripbox.com

For example if you withdraw 5000 at the beginning of the tax year you could reinvest that 5000 later in the year along with your full 20000 ISA allowance without breaching any rules. The CushonMix portfolio is made up of funds that have a low correlation with each other. Some of the different growth ISAs available include structured growth ISAs fund ISAs and those that invest in emerging markets. ARC TIME Freehold Income Authorised. He has a flexible approach of adapting the portfolio to each phase of the economic cycle Hollands said.

Source: pinterest.com

Source: pinterest.com

They could for example be firms listed on the Alternative Investment Market AIM or a company that is currently experiencing financial difficulties. The fund has one of the largest and best resourced emerging markets investment teams which are based from London New York and Singapore. One of the funds he rates most highly in this space is Cazenove UK Equity Income managed by Matt Hudson at Schroders. This is perhaps as close as you can get to a pair of safe hands in what is a volatile investment sector. As the risk profile increases to a high level so does the feasibility of a large return or a larger capital loss.

Source: investopedia.com

Source: investopedia.com

But theres no guarantee a stocks and shares ISA is a higher-risk home for your money with the returns based on the performance of the specific shares or funds so theres a chance you could lose some or all of your initial investment potentially leaving you with less than you put in. Transfer an ISA Transfer an ISA and consolidate your investments with one provider. Fidelity Best Stocks and Shares ISA for Mutual Fund Investing. VT Downing Unique Opportunities. The managers look for companies which dont have too much borrowing that produce high and stable returns and operate on higher than average margins.

Source: whatinvestment.co.uk

Source: whatinvestment.co.uk

There is a limit of 20000 you can invest each. There is a limit of 20000 you can invest each. The iShares Core FTSE 100 UCITS ETF ISF can also earn extra returns for investors because it lends out securities it owns to short sellers for cash. This is perhaps as close as you can get to a pair of safe hands in what is a volatile investment sector. The fund has delivered a 164 return over 12 months.

Source: bankofscotland.co.uk

Source: bankofscotland.co.uk

The fund has one of the largest and best resourced emerging markets investment teams which are based from London New York and Singapore. This fund aims to pay a higher income than many other funds. Read Fortune doesnt always favour the brave article Read article. Patrick Connollys Top Five Aggressive Funds. Growth funds tend to be higher risk funds and are therefore suited to those looking to build their savings or pension over a longer period of time.

Source: ro.pinterest.com

Source: ro.pinterest.com

The long term asset mix is made up of 98 Equity and 2 Cash. If you open a stocks and shares ISA any profits and dividends are tax free. Premier Miton European Opportunities. The fund has one of the largest and best resourced emerging markets investment teams which are based from London New York and Singapore. Carlos Moreno Thomas Brown.

Source: halifax.co.uk

Source: halifax.co.uk

The long term asset mix is made up of 98 Equity and 2 Cash. Junior ISAs Junior ISAs give you a 9000 annual allowance to invest for the children in your life. Navigator funds hold various asset classes and regions to target specific goals and risk tolerances and to help limit exposure to a single asset or risk. They will be volatile thats not really risk which means that you risk losing say 15 to 25 in a year very rare but they could and do grow 20 to 40 in a year. These are essentially high-risk high-return stocks.

Source: shiftingshares.com

Source: shiftingshares.com

For example if you withdraw 5000 at the beginning of the tax year you could reinvest that 5000 later in the year along with your full 20000 ISA allowance without breaching any rules. Either way you should probably avoid adding more than 10 of your. Shares form most of the fund and have the potential to generate an income and long-term growth. VT Downing Global Investors. The funds fall into three categories.

Source: pinterest.com

Source: pinterest.com

Patrick Connollys Top Five Aggressive Funds. At the time of writing the equity fund with the largest percentage increase in NAV over the last year is Global Internet Leaders SICAV-FIS I a Luxembourg German listed fund that is only accessible to professional investors. The managers look for companies which dont have too much borrowing that produce high and stable returns and operate on higher than average margins. Growth funds tend to be higher risk funds and are therefore suited to those looking to build their savings or pension over a longer period of time. For example if you withdraw 5000 at the beginning of the tax year you could reinvest that 5000 later in the year along with your full 20000 ISA allowance without breaching any rules.

Source: ii.co.uk

Source: ii.co.uk

And avoid the risk of low growth by investing in wealth producing countries and industries. Hollands also advocates equity income funds specifically those which target companies with good cash flow. If you open a stocks and shares ISA any profits and dividends are tax free. These are essentially high-risk high-return stocks. A Flexi-ISA allows you to reinvest any withdrawals youve made in the same tax year without losing your allowance.

Source: investopedia.com

Source: investopedia.com

Investors in this ETF also earn dividends generated from the FTSE 100 index as this index is full of industry titans and the more stable businesses. Open an ISA Open a Stocks Shares ISA online in minutes. We provide risk ratings for all the funds in our Platinum 120 and weekly fund in focus. Putting your money in an ISA is a tax efficient way to save or invest. Five top ISA funds for 2019.

Source: pinterest.com

Source: pinterest.com

Hollands also advocates equity income funds specifically those which target companies with good cash flow. ARC TIME Freehold Income Authorised. At the time of writing the equity fund with the largest percentage increase in NAV over the last year is Global Internet Leaders SICAV-FIS I a Luxembourg German listed fund that is only accessible to professional investors. One of the funds he rates most highly in this space is Cazenove UK Equity Income managed by Matt Hudson at Schroders. Three investment experts reveal the funds they think look promising this year for low medium and high risk ISA investors.

Source:

Source:

VT Downing Global Investors. The CushonMix portfolio is made up of funds that have a low correlation with each other. Assets grow at different rates which means your asset allocation may no longer reflect your attitude to risk over time. Fidelity Best Stocks and Shares ISA for Mutual Fund Investing. Patrick Connollys Top Five Aggressive Funds.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title high risk isa funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.