Your High risk vanguard etf news are available in this site. High risk vanguard etf are a mining that is most popular and liked by everyone this time. You can News the High risk vanguard etf files here. Download all royalty-free coin.

If you’re looking for high risk vanguard etf images information linked to the high risk vanguard etf keyword, you have come to the right blog. Our website frequently gives you suggestions for seeking the highest quality video and picture content, please kindly search and locate more informative video content and images that fit your interests.

High Risk Vanguard Etf. Stocks can also be domestic or international. In joint brokerage college savings or small-business accounts. Dips in the stock market tend to be worse than in the bond market. BND currently yields about 14 too which is roughly equal to the SP 500 index of stocks with a much smaller chance of volatility.

11 Low Cost Vanguard Etfs You Can Buy And Hold Forever Etf Focus On Thestreet Etf Research And Trade Ideas From thestreet.com

11 Low Cost Vanguard Etfs You Can Buy And Hold Forever Etf Focus On Thestreet Etf Research And Trade Ideas From thestreet.com

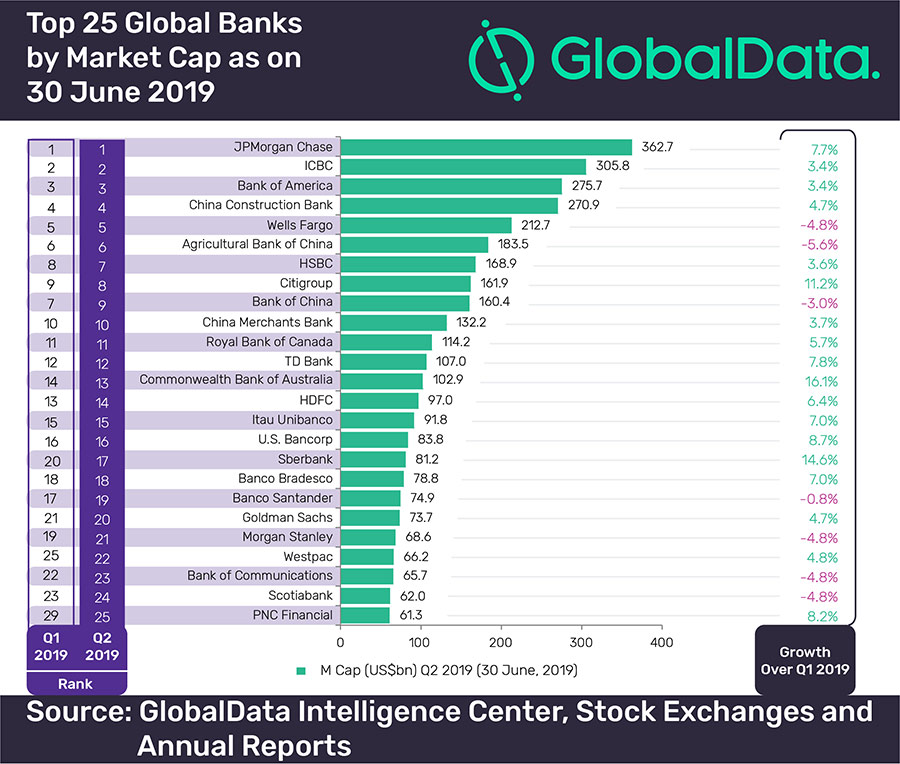

It is 45 because it is relatively risky when compared to safer investments such as bonds. JPMorgan Chase Co. Procter Gamble Co. Getting a larger return in exchange for a larger amount of risk. Eight of the best Vanguard ETFs for retirees. The fund is administered by Vanguard the second-largest investment managers in the.

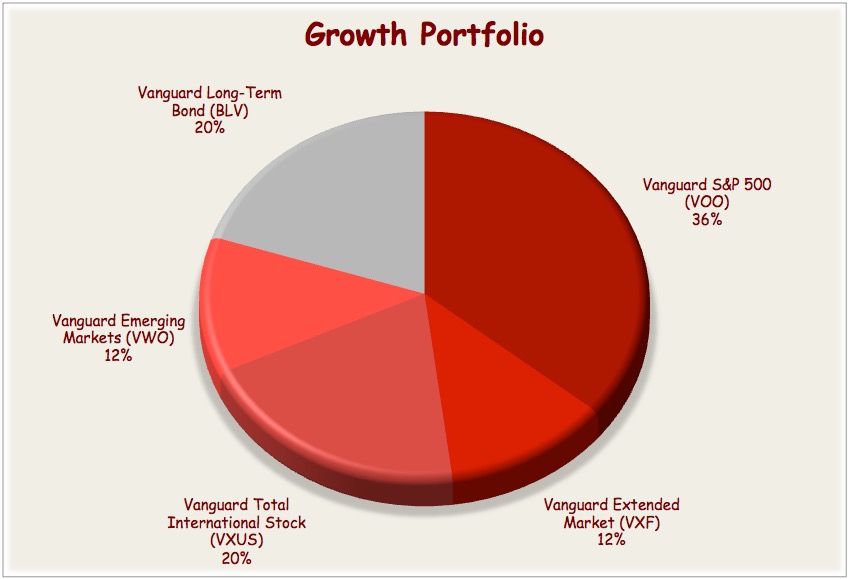

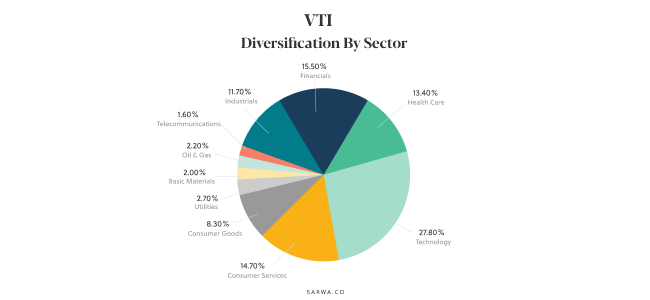

Because the fund invests in 500 companies your investment is instantly diversified across several leading industries in the US and throughout the world.

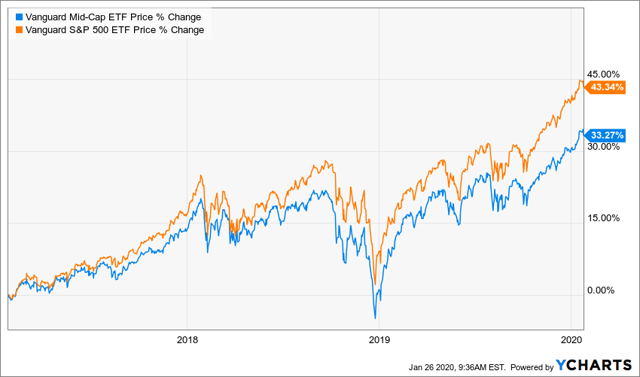

Based on returns total assets under management and prevailing market conditions we have selected our top 10 Vanguard ETFs. It is 45 because it is relatively risky when compared to safer investments such as bonds. This combination of high yield ETFs should do a solid job of providing diversification and risk mitigation while allowing income seekers to start collecting some larger checks. Hi Im new ish to investing. To my knowledge silver is the one that has the biggest potential reward and risk. Vanguard ETFs to buy help mitigate potential losses by spreading the risk across high-quality names.

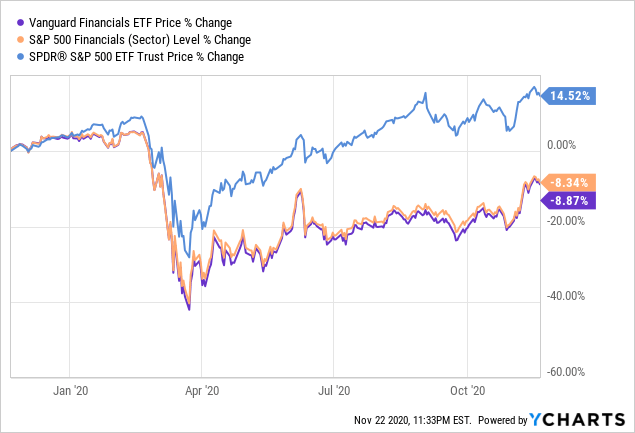

Source: seekingalpha.com

Source: seekingalpha.com

VBR is an index ETF investing in small-cap value stocks. It is 45 because it is relatively risky when compared to safer investments such as bonds. Quote Fund Analysis Performance Risk Price Portfolio Parent. With about 96 holdings it effectively diversifies. For people who invest through their employer in a Vanguard 401 k 403 b or other retirement plan.

Source: seekingalpha.com

Source: seekingalpha.com

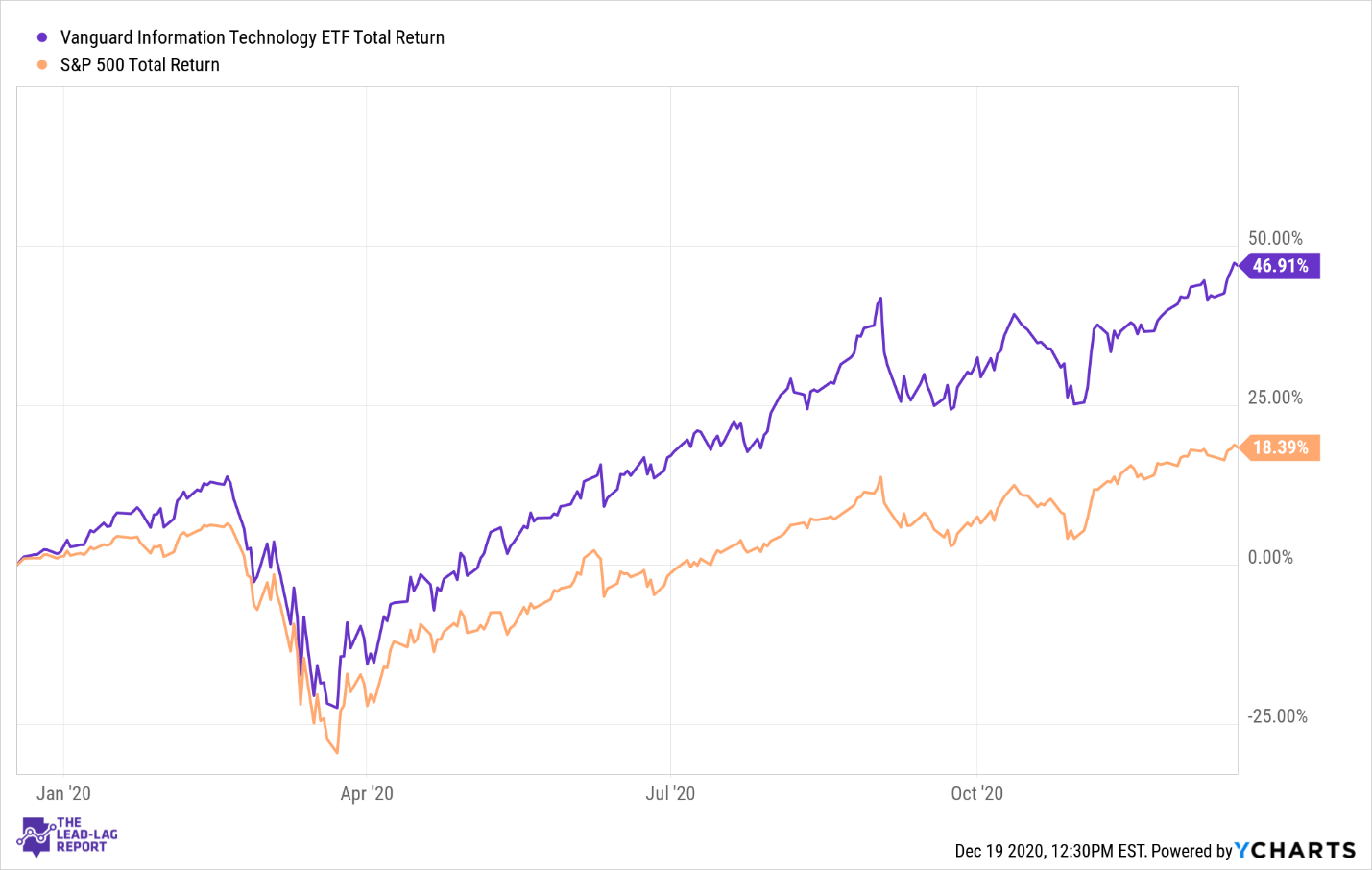

Analyst rating as of Sep 13 2021. The Vanguard Information. Hi Im new ish to investing. Vanguard lists this ETF as a 4 out of 5 in its Risk potential with 5 being this highest risk. Similar funds have an average expense ratio approaching 1 and many are even higher.

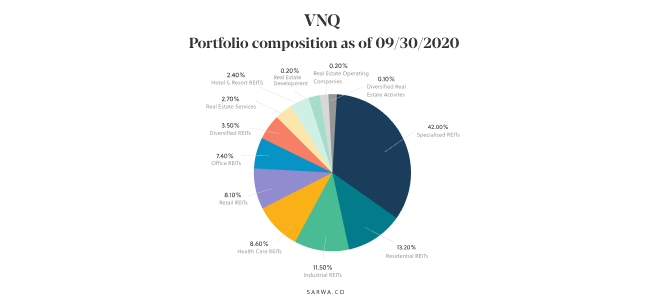

Source: sarwa.co

Source: sarwa.co

In joint brokerage college savings or small-business accounts. The Vanguard Emerging Markets Government Bond ETF NASDAQ. A mutual fund touted as aggressive growth. Click on the tabs below to see more information on Aggressive Growth ETFs including historical performance dividends holdings expense ratios technical indicators analysts reports and more. Vanguards SP 500 ETF gives you exposure to powerhouse companies with a low expense ratio of 003.

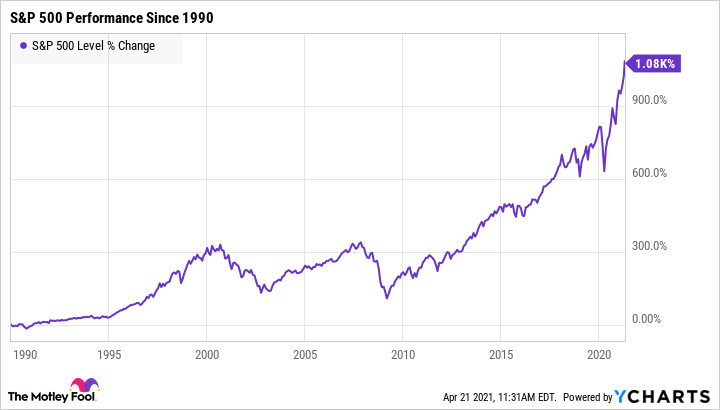

Source: fool.com

Source: fool.com

Furthermore many if not most investors have day jobs. This ETFs top 10 holdings as of 3312019 are. Based on returns total assets under management and prevailing market conditions we have selected our top 10 Vanguard ETFs. Analyst rating as of Sep 13 2021. JPMorgan Chase Co.

Source: seekingalpha.com

Source: seekingalpha.com

VBR is an index ETF investing in small-cap value stocks. Speaking of risks. For people who invest through their employer in a Vanguard 401 k 403 b or other retirement plan. With about 96 holdings it effectively diversifies. Click on the tabs below to see more information on Aggressive Growth ETFs including historical performance dividends holdings expense ratios technical indicators analysts reports and more.

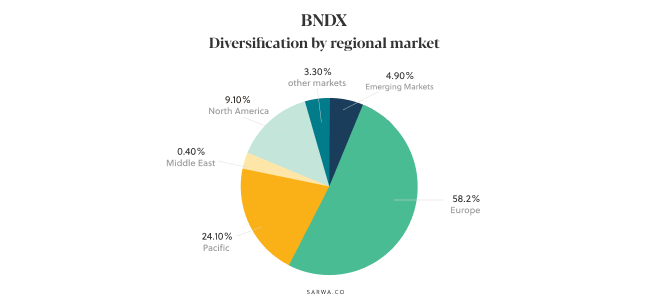

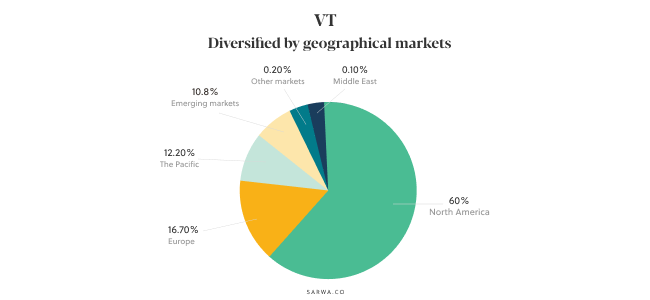

Source: sarwa.co

Source: sarwa.co

For people who invest through their employer in a Vanguard 401 k 403 b or other retirement plan. Because the fund invests in 500 companies your investment is instantly diversified across several leading industries in the US and throughout the world. Vanguard lists this ETF as a 4 out of 5 in its Risk potential with 5 being this highest risk. It tends to follow gold somewhat but it has higher volatility. VBR is an index ETF investing in small-cap value stocks.

Source: thestreet.com

Source: thestreet.com

Vanguard ETFs to buy help mitigate potential losses by spreading the risk across high-quality names. The ETF has a beta of 170 and standard deviation of 4079 for the trailing three-year period making it a high risk choice in the space. Based on returns total assets under management and prevailing market conditions we have selected our top 10 Vanguard ETFs. With about 96 holdings it effectively diversifies. Vanguards SP 500 ETF gives you exposure to powerhouse companies with a low expense ratio of 003.

Source: seekingalpha.com

Source: seekingalpha.com

As with bonds its smart to consider holding both. Quote Fund Analysis Performance Risk Price Portfolio Parent. The Vanguard Information. Vanguard lists this ETF as a 4 out of 5 in its Risk potential with 5 being this highest risk. This investment can be considered the Bitcoin of the ETF world because its one of the higher-risk ETFs but its also seen substantial gains over the past year.

Source: sarwa.co

Source: sarwa.co

Quote Fund Analysis Performance Risk Price Portfolio Parent. The Vanguard Information. As with bonds its smart to consider holding both. It is 45 because it is relatively risky when compared to safer investments such as bonds. Stock prices could drop for a variety of reasons including poor performance of certain companies and concern about the economy.

Source: qctimes.com

Source: qctimes.com

Procter Gamble Co. Stock prices could drop for a variety of reasons including poor performance of certain companies and concern about the economy. Hi Im new ish to investing. Getting a larger return in exchange for a larger amount of risk. Stocks are risky but they provide higher returns than bonds.

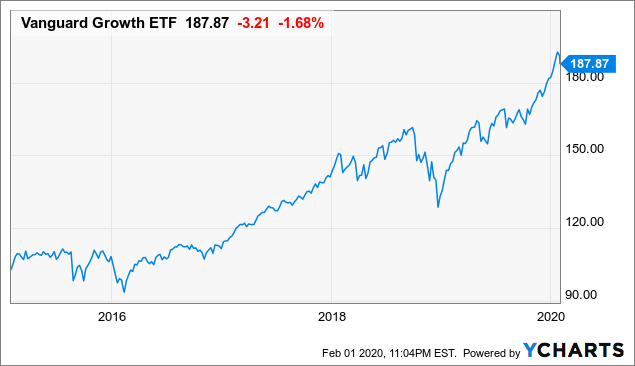

Source: fool.com

Source: fool.com

Getting a larger return in exchange for a larger amount of risk. This investment can be considered the Bitcoin of the ETF world because its one of the higher-risk ETFs but its also seen substantial gains over the past year. To my knowledge silver is the one that has the biggest potential reward and risk. It is 45 because it is relatively risky when compared to safer investments such as bonds. SLV is an example ETF for that.

Source: knowingwall.com

Source: knowingwall.com

With about 96 holdings it effectively diversifies. It is 45 because it is relatively risky when compared to safer investments such as bonds. Dips in the stock market tend to be worse than in the bond market. There is some systemic risk that may cause them to crash along with the rest of the market but in times of turmoil people do tend to put money in precious metals. A mutual fund touted as aggressive growth.

Source: advisors.vanguard.com

Source: advisors.vanguard.com

BND currently yields about 14 too which is roughly equal to the SP 500 index of stocks with a much smaller chance of volatility. For people who invest through their employer in a Vanguard 401 k 403 b or other retirement plan. Consider these high-risk high-reward investments carefully. Quote Fund Analysis Performance Risk Price Portfolio Parent. Dips in the stock market tend to be worse than in the bond market.

Source: seekingalpha.com

Source: seekingalpha.com

Hi Im new ish to investing. To my knowledge silver is the one that has the biggest potential reward and risk. Because the fund invests in 500 companies your investment is instantly diversified across several leading industries in the US and throughout the world. A mutual fund touted as aggressive growth. The Vanguard Information.

Source: sarwa.co

Source: sarwa.co

Of the two which would you choose. Quote Fund Analysis Performance Risk Price Portfolio Parent. Vanguard High Dividend Yield ETF. Vanguards SP 500 ETF gives you exposure to powerhouse companies with a low expense ratio of 003. This ETFs top 10 holdings as of 3312019 are.

Source: fool.com

Source: fool.com

Stock prices could drop for a variety of reasons including poor performance of certain companies and concern about the economy. The Vanguard Information. Analyst rating as of Sep 13 2021. Aggressive Growth ETFs are aimed at providing growth using aggressive tactics meaning they have a high riskreward profile. Similar funds have an average expense ratio approaching 1 and many are even higher.

Source: seekingalpha.com

Source: seekingalpha.com

Based on returns total assets under management and prevailing market conditions we have selected our top 10 Vanguard ETFs. The Vanguard Emerging Markets Government Bond ETF NASDAQ. Quote Fund Analysis Performance Risk Price Portfolio Parent. Eight of the best Vanguard ETFs for retirees. Vanguard Growth ETF VUG Vanguard Information Technology ETF VGT Vanguard Consumer Discretionary ETF VCR Vanguard Extended Market ETF VXF Vanguard Large Cap ETF VV Vanguard ESG US Stock ETF ESGV.

Source: fool.com

Source: fool.com

Stock prices could drop for a variety of reasons including poor performance of certain companies and concern about the economy. For people who invest directly in individual accounts including IRAs and rollovers. Stocks are risky but they provide higher returns than bonds. The Vanguard Emerging Markets Government Bond ETF NASDAQ. The ETF has a beta of 170 and standard deviation of 4079 for the trailing three-year period making it a high risk choice in the space.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title high risk vanguard etf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.