Your Junk bonds risk trading are available in this site. Junk bonds risk are a exchange that is most popular and liked by everyone today. You can Find and Download the Junk bonds risk files here. Download all royalty-free exchange.

If you’re searching for junk bonds risk pictures information linked to the junk bonds risk topic, you have pay a visit to the ideal blog. Our website always provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

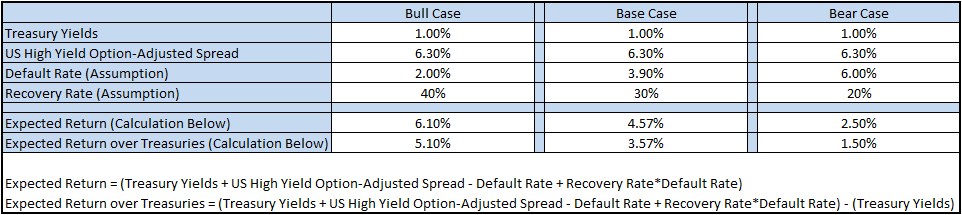

Junk Bonds Risk. A junk bond is a high-yield bond that carries a higher risk of default than other investment-grade bonds. Junk bonds also known as a speculative-grade bonds are high-yield fixed income securities with an elevated risk of default on payment. Junk Bond Definition. Yes junk bonds are risky but every investment carries its own level of risk.

Credit Risk From efficientfrontier.com

Credit Risk From efficientfrontier.com

Junk Bond Definition. Junk bonds the market. The credit rating of a high yield bond is considered speculative grade or below investment grade This means that the chance of default with junk bonds is higher than for other types of bonds. If a bond payer defaults it will significantly hurt the price of the bond since cash flows generally cease and a portion of the principal balance might be uncollectible. Junk bonds are more likely to face volatility due to the financial uncertainty of the business. You purchase the bond from its issuer the principal and the issuer promises to pay you back by the bonds maturity date with interest coupon on the money it borrows through.

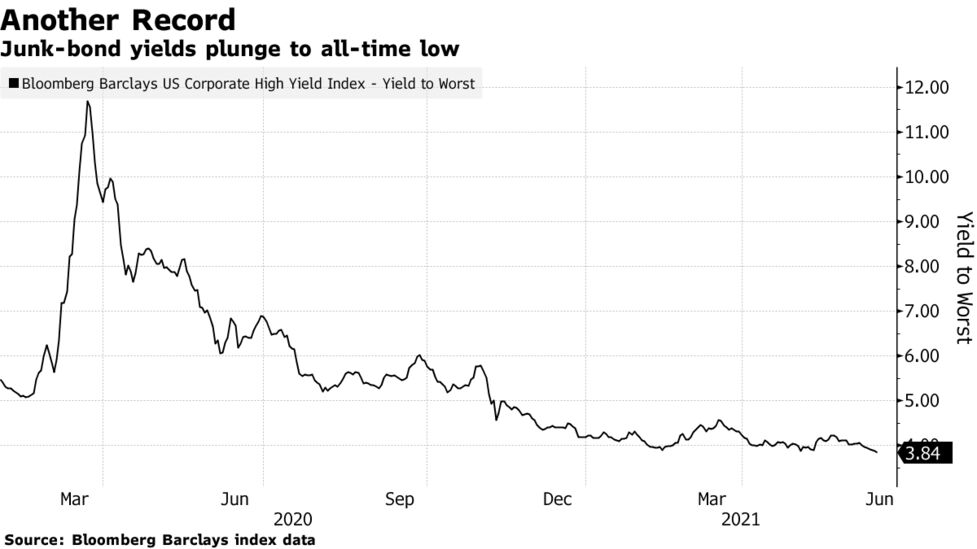

The high-yield market periodically experiences higher levels of default but the long-term average default rate is only 4.

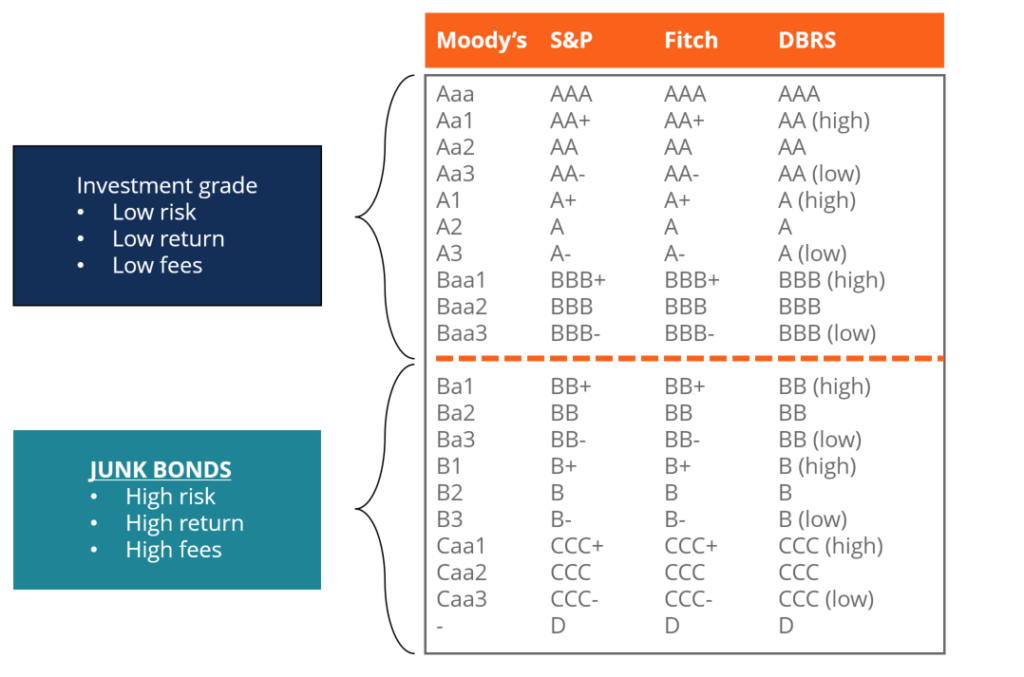

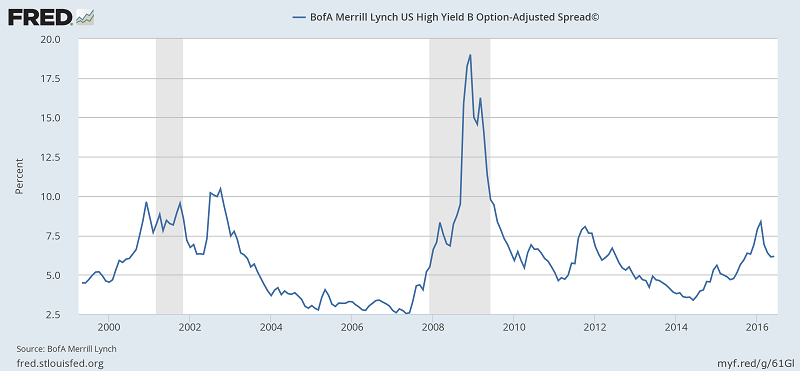

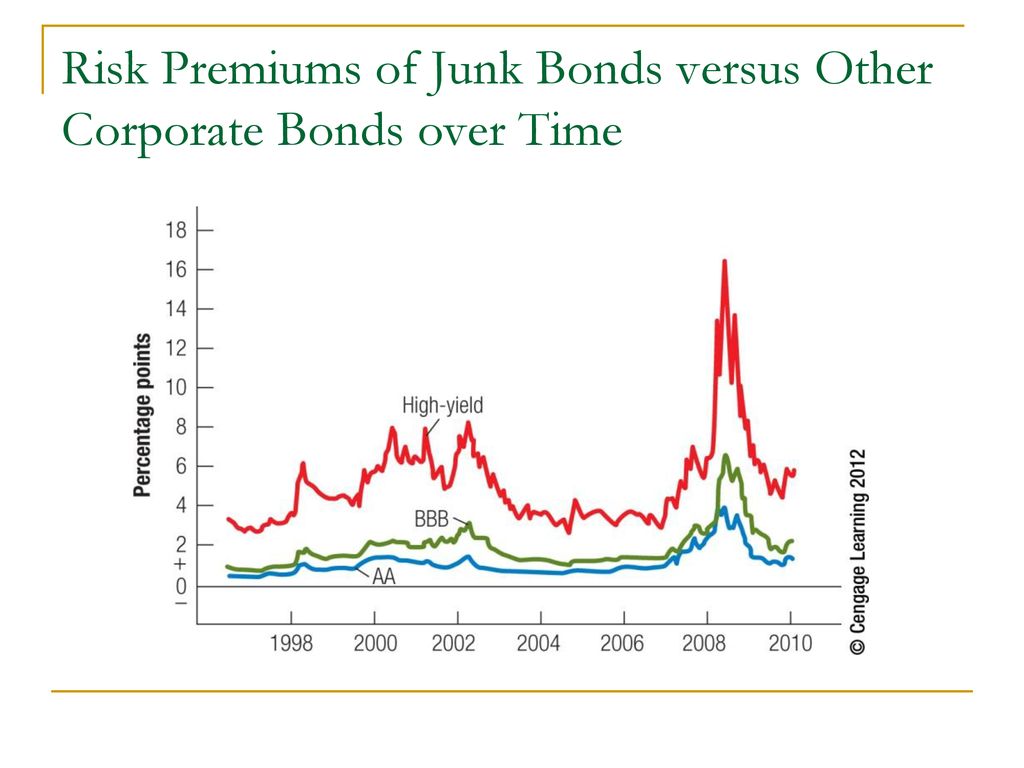

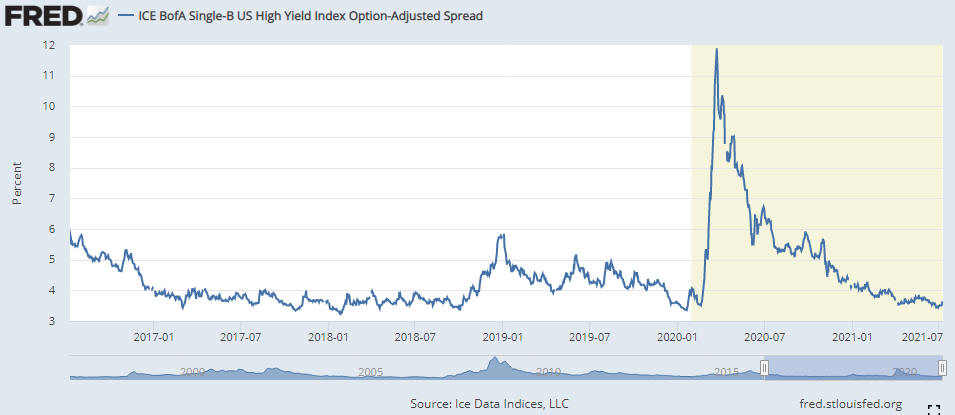

Junk bonds carry a number of risks for investors. The junk bond market tells us how much risk investors are willing to face. Junk bonds are easy to spot when you review lists of potential bond investments as they earn credit ratings of BB or below from ratings agencies such as Standard Poors SP or Fitch or a rating of Ba or below from Moodys. Are Junk Bonds Safe. Junk bonds serve as a risk indicator of when investors are willing to take on risk or avoid risk in the market. These include risks associated with the company issuing junk bonds as well as risks arising from wider economic conditions.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Who Buys Junk Bonds. Bond ratings measure the perceived risk that the bonds. Default risk is the chance that a company or government will be unable to pay its obligations when the bonds mature. Low-risk saving just got considerably more lucrative. And the risk of default is higher than investment grade corporate or municipal bonds.

Source: investopedia.com

Source: investopedia.com

Junk bonds or high yield bonds are issued by a company that is considered to be a higher credit risk. Bond ratings measure the perceived risk that the bonds. Low-risk saving just got considerably more lucrative. Forget cryptocurrencies and junk bonds individuals can now get a. J unk bonds also known less pejoratively as high-yield bonds are bonds that are rated as speculative or below investment grade issues.

Source: investopedia.com

Source: investopedia.com

These include risks associated with the company issuing junk bonds as well as risks arising from wider economic conditions. The obvious caveat is that junk bonds are a high-risk investment. Junk bonds carry high interest rates to offset a perceived high risk of default. Cons Junk bonds have a higher risk of default than most bonds with better credit. Junk bonds are more likely to face volatility due to the financial uncertainty of the business.

Source: bloomberg.com

Source: bloomberg.com

These include risks associated with the company issuing junk bonds as well as risks arising from wider economic conditions. A junk bond is a high-yield bond that carries a higher risk of default than other investment-grade bonds. Its important to note that all investments come with. The high-yield market periodically experiences higher levels of default but the long-term average default rate is only 4. Junk bonds also known as a speculative-grade bonds are high-yield fixed income securities with an elevated risk of default on payment.

Source: currentmarketvaluation.com

Source: currentmarketvaluation.com

Forget cryptocurrencies and junk bonds individuals can now get a. Theres a risk that the issuer will file for bankruptcy and youll never get your money back. Low-risk saving just got considerably more lucrative. The obvious caveat is that junk bonds are a high-risk investment. If a bond payer defaults it will significantly hurt the price of the bond since cash flows generally cease and a portion of the principal balance might be uncollectible.

Source: investopedia.com

Source: investopedia.com

Junk bonds also known as a speculative-grade bonds are high-yield fixed income securities with an elevated risk of default on payment. Its important to note that all investments come with. If a bond payer defaults it will significantly hurt the price of the bond since cash flows generally cease and a portion of the principal balance might be uncollectible. These include risks associated with the company issuing junk bonds as well as risks arising from wider economic conditions. November 1 2021 648 PM PDT.

Source: colofinancial.com

Source: colofinancial.com

Cons Junk bonds have a higher risk of default than most bonds with better credit. Bond ratings of AAA are the highest quality offerings. Default risk is the chance that a company or government will be unable to pay its obligations when the bonds mature. Low-risk saving just got considerably more lucrative. Theres a risk that the issuer will file for bankruptcy and youll never get your money back.

Source: wolfstreet.com

Source: wolfstreet.com

The credit rating of a high yield bond is considered speculative grade or below investment grade This means that the chance of default with junk bonds is higher than for other types of bonds. The credit rating of a high yield bond is considered speculative grade or below investment grade This means that the chance of default with junk bonds is higher than for other types of bonds. Junk bonds or high yield bonds are issued by a company that is considered to be a higher credit risk. Bond ratings of AAA are the highest quality offerings. Junk bonds also known as a speculative-grade bonds are high-yield fixed income securities with an elevated risk of default on payment.

Source: colofinancial.com

Source: colofinancial.com

Junk bonds are easy to spot when you review lists of potential bond investments as they earn credit ratings of BB or below from ratings agencies such as Standard Poors SP or Fitch or a rating of Ba or below from Moodys. Yes junk bonds are risky but every investment carries its own level of risk. The junk bond market tells us how much risk investors are willing to face. Junk bonds are usually issued by companies that have a history of not paying their interest payments and that are struggling financially which is why junk bonds have higher interest rates to. In finance a high-yield bond non-investment-grade bond speculative-grade bond or junk bond is a bond that is rated below investment grade by credit rating agenciesThese bonds have a higher risk of default or other adverse credit events but offer higher yields than investment-grade bonds in order to compensate for the increased risk.

Source: servowealth.com

Source: servowealth.com

Junk bonds are usually issued by companies that have a history of not paying their interest payments and that are struggling financially which is why junk bonds have higher interest rates to. Junk bonds are more likely to face volatility due to the financial uncertainty of the business. While an investment-grade credit rating denotes little risk that a company will default on its debt junk bonds carry the highest risk of a company missing an interest payment called default risk. A bond can receive a lower credit rating because of the risk of default on the part of the entity issuing the bond. Below BBB for bonds rated by Moodys and below Baa for bonds rated by Standard and Poors the two main debt-rating agencies.

Source: thismatter.com

Source: thismatter.com

Bond ratings measure the perceived risk that the bonds. Otherwise a junk bond is not actually much different from any other bond. Cons Junk bonds have a higher risk of default than most bonds with better credit. Junk bonds also known as a speculative-grade bonds are high-yield fixed income securities with an elevated risk of default on payment. Junk bonds or high-yield bonds carry a higher risk of default than investment-grade corporate bonds.

Source: servowealth.com

Source: servowealth.com

Junk bonds are easy to spot when you review lists of potential bond investments as they earn credit ratings of BB or below from ratings agencies such as Standard Poors SP or Fitch or a rating of Ba or below from Moodys. These include risks associated with the company issuing junk bonds as well as risks arising from wider economic conditions. Its important to note that all investments come with. Bond ratings of AAA are the highest quality offerings. While an investment-grade credit rating denotes little risk that a company will default on its debt junk bonds carry the highest risk of a company missing an interest payment called default risk.

Source: slideplayer.com

Source: slideplayer.com

Otherwise a junk bond is not actually much different from any other bond. Who Buys Junk Bonds. Junk bonds carry high interest rates to offset a perceived high risk of default. The junk bond market tells us how much risk investors are willing to face. Junk bonds the market.

Source: thismatter.com

Source: thismatter.com

These include risks associated with the company issuing junk bonds as well as risks arising from wider economic conditions. A junk bond is a high-yield bond that carries a higher risk of default than other investment-grade bonds. You purchase the bond from its issuer the principal and the issuer promises to pay you back by the bonds maturity date with interest coupon on the money it borrows through. Are Junk Bonds Safe. Otherwise a junk bond is not actually much different from any other bond.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

What are Junk Bonds. These include risks associated with the company issuing junk bonds as well as risks arising from wider economic conditions. Bond ratings of AAA are the highest quality offerings. Cons Junk bonds have a higher risk of default than most bonds with better credit. Low-risk saving just got considerably more lucrative.

Source: seekingalpha.com

Source: seekingalpha.com

It is an early indication of risk behaviors in the investment community. Otherwise a junk bond is not actually much different from any other bond. A junk bond is a high-yield bond that carries a higher risk of default than other investment-grade bonds. Junk bonds or high-yield bonds carry a higher risk of default than investment-grade corporate bonds. It is an early indication of risk behaviors in the investment community.

Source: forbes.com

Source: forbes.com

It is an early indication of risk behaviors in the investment community. Because junk bonds have a high default risk they are speculative. And the risk of default is higher than investment grade corporate or municipal bonds. Junk Bond Definition. Bond ratings of AAA are the highest quality offerings.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Bond ratings measure the perceived risk that the bonds. Junk bonds the market. In finance a high-yield bond non-investment-grade bond speculative-grade bond or junk bond is a bond that is rated below investment grade by credit rating agenciesThese bonds have a higher risk of default or other adverse credit events but offer higher yields than investment-grade bonds in order to compensate for the increased risk. Junk bonds or high-yield bonds carry a higher risk of default than investment-grade corporate bonds. Junk bonds carry high interest rates to offset a perceived high risk of default.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title junk bonds risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.