Your Msci emerging markets small cap index wallet are obtainable. Msci emerging markets small cap index are a news that is most popular and liked by everyone now. You can Find and Download the Msci emerging markets small cap index files here. Find and Download all royalty-free bitcoin.

If you’re searching for msci emerging markets small cap index pictures information related to the msci emerging markets small cap index topic, you have pay a visit to the right blog. Our site frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

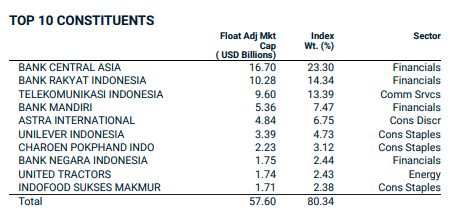

Msci Emerging Markets Small Cap Index. MSCI Global Small Cap Indexes. The MSCI Emerging Markets EM Index was launched in 1988 including 10 countries with a weight of about 09 in the MSCI ACWI Index. There will be 525 additions to and 75 deletions from the MSCI World All Cap Index. Constructed according to the MSCI Global Investable Market Indexes GIMI Methodology the MSCI EM Index is designed.

The Case For Emerging Markets Small Cap Man Institute Man Group From man.com

The Case For Emerging Markets Small Cap Man Institute Man Group From man.com

Small Cap Equities. It publishes the MSCI BRIC MSCI World and MSCI EAFE Indexes. The MSCI ACWI Index ACWI is global equity index consisting of developed and emerging market countries. With 143 constituents the index covers approximately 14 of the free float-adjusted market. ETFs Tracking The MSCI Emerging Markets Small Cap Index ETF Fund Flow The table below includes fund flow data for all US. MSCI Global Investable Market Indexes.

Listed Highland Capital Management ETFs.

The IMI indices thus offer you a market coverage of. The MSCI Emerging Markets EM Index was launched in 1988 including 10 countries with a weight of about 09 in the MSCI ACWI Index. There will be 525 additions to and 75 deletions from the MSCI World All Cap Index. With 143 constituents the index covers approximately 14 of the free float-adjusted market. MSCI Global All Cap Indexes. The IMI indices thus offer you a market coverage of.

Source: bridgeway.com

Source: bridgeway.com

Yahsat joins a number of other Abu Dhabi companies that are part of the MSCIs global indexes. Listed Highland Capital Management ETFs. Wade Financial Advisory Inc Current Portfolio buys BTC iShares MSCI Emerging Markets Multifactor ETF iShares MSCI USA Small-Cap Min Vol Factor ETF Dimensional US. Mid cap firms form the next layer of the index. The MSCI Emerging Markets Small Cap Growth Index captures small cap securities exhibiting overall growth style characteristics across 27 Emerging Markets EM countries.

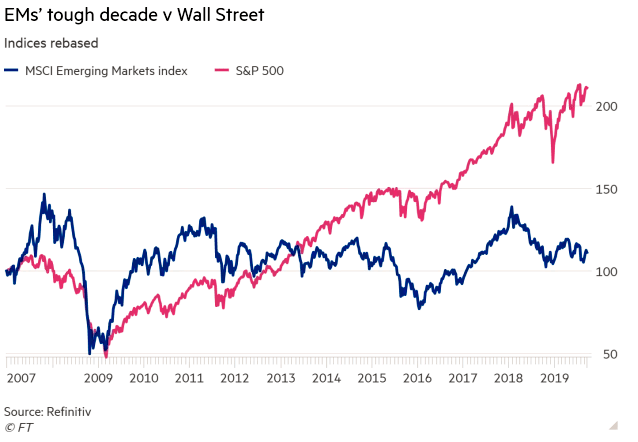

Source: ig.com

Source: ig.com

With 143 constituents the index covers approximately 14 of the free float-adjusted market. Is an American finance company headquartered in New York City and serving as a global provider of equity fixed income hedge fund stock market indexes multi-asset portfolio analysis tools and ESG products. There will be 513 additions to and 370 deletions from the MSCI ACWI Small Cap Index. Broad Market Index ETF iShares MSCI EAFE ESG Select ETF sells Invesco SP 500 Low Volatility ETF during the 3-months ended 2021Q3 according to the most recent filings of. Listed Highland Capital Management ETFs.

Source: isabelnet.com

Source: isabelnet.com

Is an American finance company headquartered in New York City and serving as a global provider of equity fixed income hedge fund stock market indexes multi-asset portfolio analysis tools and ESG products. In addition to the large and medium-sized companies these also include the smaller ones. The value investment style characteristics for index construction. In contrast the MSCI Emerging Markets Small Cap Value Index allocates just 1065. Use to customize an emerging markets stock allocation by expressing a view on small-cap stocks INVESTMENT OBJECTIVE The iShares MSCI Emerging Markets Small-Cap ETF seeks to track the investment results of an index composed of small-capitalization emerging market equities.

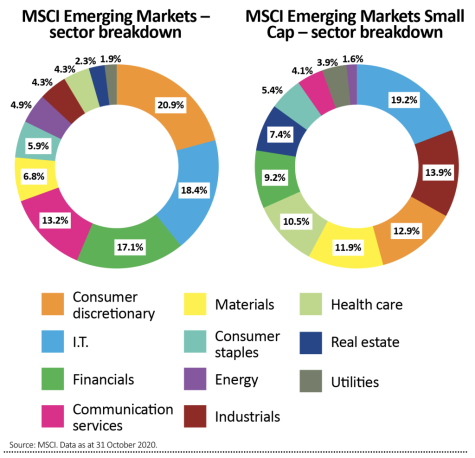

Source: sharesmagazine.co.uk

Source: sharesmagazine.co.uk

The MSCI Emerging Markets Small Cap Growth Index captures small cap securities exhibiting overall growth style characteristics across 27 Emerging Markets EM countries. With 1 ETF traded in the US. The MSCI Emerging Markets Small Cap Index measures the performance of equity securities in the bottom 14 of market capitalization of emerging market countries. Broad Market Index ETF iShares MSCI EAFE ESG Select ETF sells Invesco SP 500 Low Volatility ETF during the 3-months ended 2021Q3 according to the most recent filings of. Constructed according to the MSCI Global Investable Market Indexes GIMI Methodology the MSCI EM Index is designed.

Source: charts.equityclock.com

Source: charts.equityclock.com

There will be 513 additions to and 370 deletions from the MSCI ACWI Small Cap Index. The MSCI Emerging Markets EM Index was launched in 1988 including 10 countries with a weight of about 09 in the MSCI ACWI Index. The MSCI Emerging Markets Small Cap Growth Index captures small cap securities exhibiting overall growth style characteristics across 27 Emerging Markets EM countries. MSCI Global Small Cap Indexes. The MSCI Emerging Markets Latin America Small Cap Index includes small cap representation across 6 Emerging Markets EM countries in Latin America.

Source: investors-corner.bnpparibas-am.com

Source: investors-corner.bnpparibas-am.com

Not for public distribution. The IMI indices thus offer you a market coverage of. There will be 525 additions to and 75 deletions from the MSCI World All Cap Index. It seeks to replicate the performance of the MSCI Emerging Markets Small Cap Index by employing representative sampling methodology. It represents large and mid-cap equity performance across 23 developed markets countries.

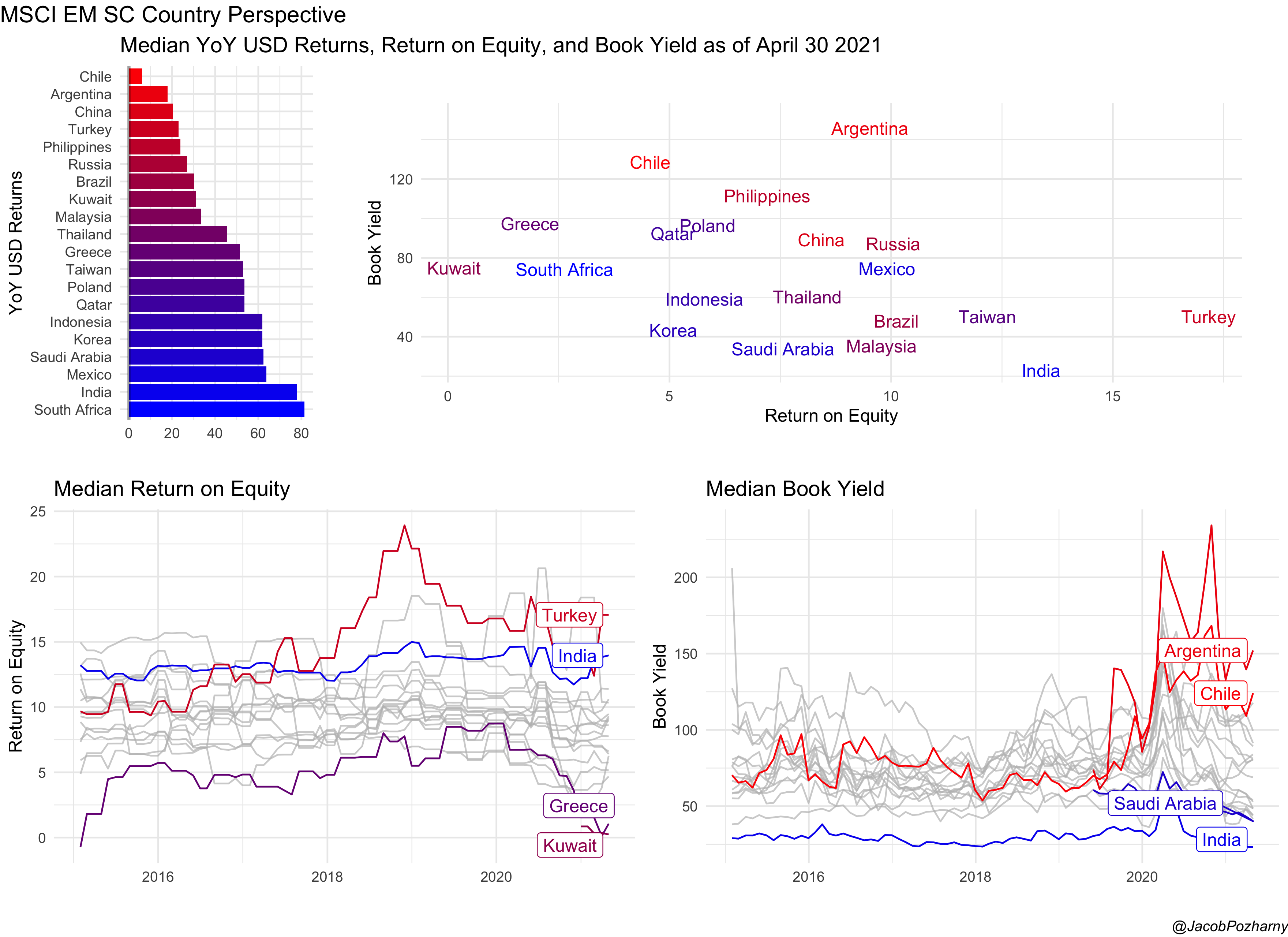

Source: man.com

Source: man.com

Listed Highland Capital Management ETFs. Large and medium-sized companies together comprise 80 - 90 of MSCI indices. Currently it captures 26 countries across the globe and has a weight of 12 in the MSCI ACWI Index. The MSCI World Index offers a broad global equity benchmark without emerging markets exposure. Small Cap ETF Schwab Fundamental US.

Source: ig.com

Source: ig.com

Small cap stocks such as the components of an index like the Russell 2000 have certainly felt the impacts of the Coronavirus. ETFs trade like stocks are subject to investment risk fluctuate in market value and may trade at. There will be 513 additions to and 370 deletions from the MSCI ACWI Small Cap Index. The MSCI Emerging Markets EM Index was launched in 1988 including 10 countries with a weight of about 09 in the MSCI ACWI Index. Is an American finance company headquartered in New York City and serving as a global provider of equity fixed income hedge fund stock market indexes multi-asset portfolio analysis tools and ESG products.

In addition to the large and medium-sized companies these also include the smaller ones. Constructed according to the MSCI Global Investable Market Indexes GIMI Methodology the MSCI EM Index is designed. Small cap stocks such as the components of an index like the Russell 2000 have certainly felt the impacts of the Coronavirus. In contrast the MSCI Emerging Markets Small Cap Value Index allocates just 1065. Small Cap ETF Schwab Fundamental US.

Small Cap Equities. Currently it captures 26 countries across the globe and has a weight of 12 in the MSCI ACWI Index. The MSCI Emerging Markets EM Index was launched in 1988 including 10 countries with a weight of about 09 in the MSCI ACWI Index. There will be 523 additions to and 374 deletions from the MSCI ACWI Investable Market Index IMI. The MSCI World Index offers a broad global equity benchmark without emerging markets exposure.

Source: msci.com

Source: msci.com

Small cap stocks such as the components of an index like the Russell 2000 have certainly felt the impacts of the Coronavirus. It represents large and mid-cap equity performance across 23 developed markets countries. ETFs Tracking The MSCI Emerging Markets Small Cap Index ETF Fund Flow The table below includes fund flow data for all US. Use to customize an emerging markets stock allocation by expressing a view on small-cap stocks INVESTMENT OBJECTIVE The iShares MSCI Emerging Markets Small-Cap ETF seeks to track the investment results of an index composed of small-capitalization emerging market equities. The average expense ratio is 070.

Source: man.com

Source: man.com

In addition to the large and medium-sized companies these also include the smaller ones. In 2018 MSCI announced it would begin including mainland Chinese A shares in its emerging markets index. The MSCI Emerging Markets Small Cap Growth Index captures small cap securities exhibiting overall growth style characteristics across 27 Emerging Markets EM countries. In contrast the MSCI Emerging Markets Small Cap Value Index allocates just 1065. There will be 513 additions to and 370 deletions from the MSCI ACWI Small Cap Index.

Source: cnbcindonesia.com

Source: cnbcindonesia.com

MSCI Global Investable Market Indexes. Is an American finance company headquartered in New York City and serving as a global provider of equity fixed income hedge fund stock market indexes multi-asset portfolio analysis tools and ESG products. It publishes the MSCI BRIC MSCI World and MSCI EAFE Indexes. The MSCI Emerging Markets EM Index was launched in 1988 including 10 countries with a weight of about 09 in the MSCI ACWI Index. Small Cap ETF Schwab Fundamental US.

Source: man.com

Source: man.com

There will be 525 additions to and 75 deletions from the MSCI World All Cap Index. ETFs trade like stocks are subject to investment risk fluctuate in market value and may trade at. The MSCI World Index offers a broad global equity benchmark without emerging markets exposure. The MSCI Emerging Markets EM Index was launched in 1988 including 10 countries with a weight of about 09 in the MSCI ACWI Index. To get the 10 - 20 small cap slice on top of mid and large caps look out for MSCIs investable market indices IMI.

Source: seekingalpha.com

Source: seekingalpha.com

Constructed according to the MSCI Global Investable Market Indexes GIMI Methodology the MSCI EM Index is designed. Listed Highland Capital Management ETFs. The IMI indices thus offer you a market coverage of. ETFs trade like stocks are subject to investment risk fluctuate in market value and may trade at. The MSCI ACWI Index ACWI is global equity index consisting of developed and emerging market countries.

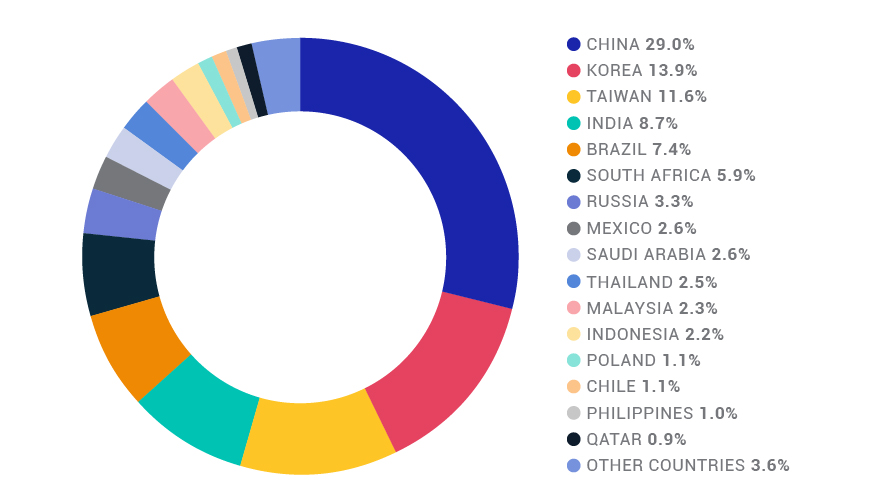

Source: bridgeway.com

Source: bridgeway.com

Large and medium-sized companies together comprise 80 - 90 of MSCI indices. In May Abu Dhabi-based food and beverage company Agthia and the UAEs largest fuel retailer Adnoc Distribution were included in the MSCIs Small Cap Emerging Markets index and the MSCI Emerging Markets index respectively. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. The IMI Large Mid SMID Micro Cap Small Micro Cap All Cap EM FM and ACWI Small Cap Indexes and their corresponding Value and Growth Indexes together with the Provisional Standard DM Provisional Small Cap and DM Small Cap Value and Growth Indexes are all based on the MSCI Global Investable Market Indexes Methodology. The MSCI Emerging Markets Small Cap Growth Index captures small cap securities exhibiting overall growth style characteristics across 27 Emerging Markets EM countries.

Source: msci.com

Source: msci.com

Currently it captures 26 countries across the globe and has a weight of 12 in the MSCI ACWI Index. The MSCI Emerging Markets Small Cap Index measures the performance of equity securities in the bottom 14 of market capitalization of emerging market countries. There will be 513 additions to and 370 deletions from the MSCI ACWI Small Cap Index. MSCI Global Investable Market Indexes. The MSCI Emerging Markets Latin America Small Cap Index includes small cap representation across 6 Emerging Markets EM countries in Latin America.

Source: bloomberg.com

Source: bloomberg.com

In 2018 MSCI announced it would begin including mainland Chinese A shares in its emerging markets index. The MSCI Emerging Markets Small Cap Value Weighted Index reweights each security of. In addition to the large and medium-sized companies these also include the smaller ones. The MSCI Emerging Markets Small Cap Index measures the performance of equity securities in the bottom 14 of market capitalization of emerging market countries. There will be 525 additions to and 75 deletions from the MSCI World All Cap Index.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title msci emerging markets small cap index by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.