Your Multifamily cap rates 2020 coin are ready in this website. Multifamily cap rates 2020 are a news that is most popular and liked by everyone this time. You can Download the Multifamily cap rates 2020 files here. Get all royalty-free coin.

If you’re searching for multifamily cap rates 2020 pictures information related to the multifamily cap rates 2020 topic, you have come to the ideal site. Our site always provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

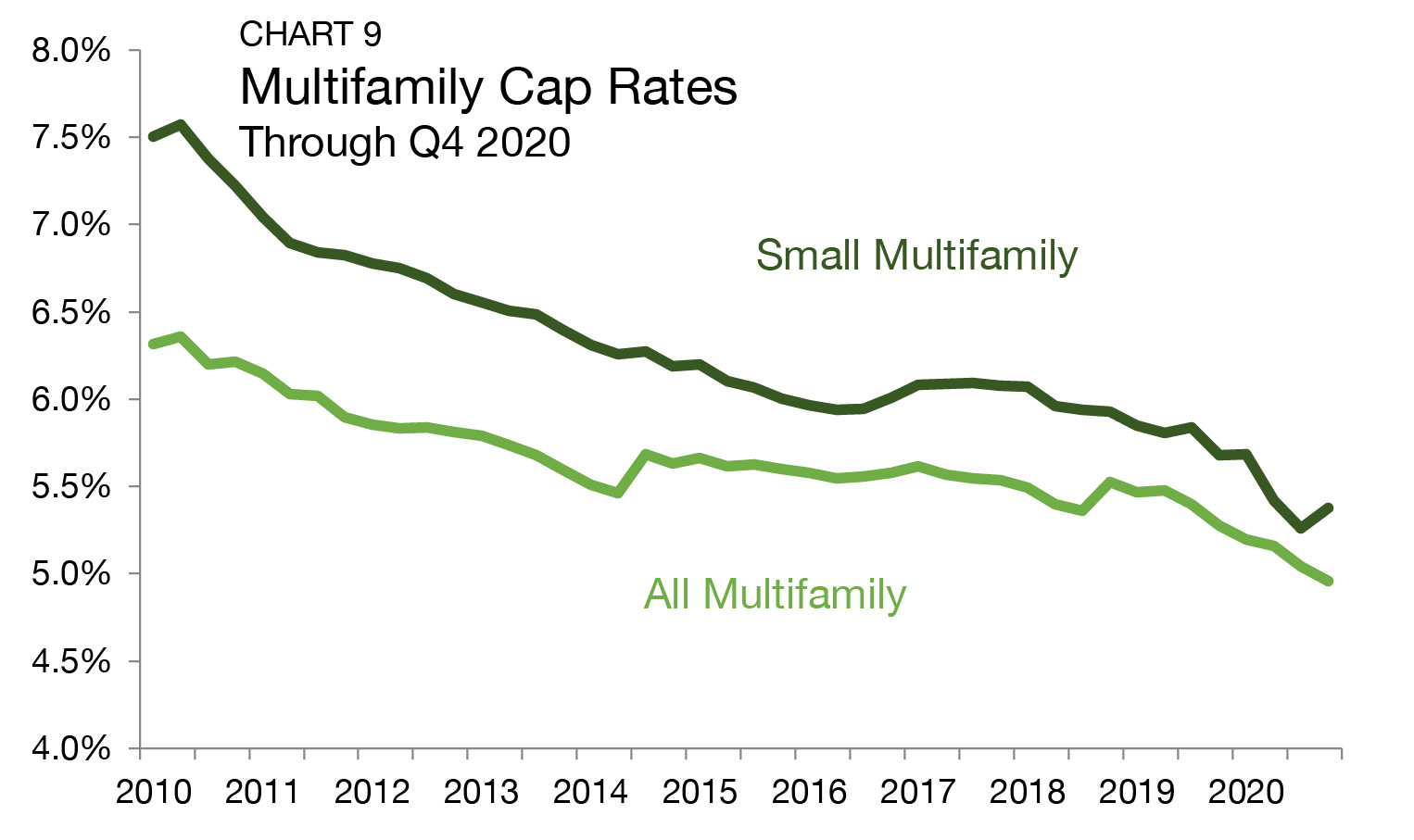

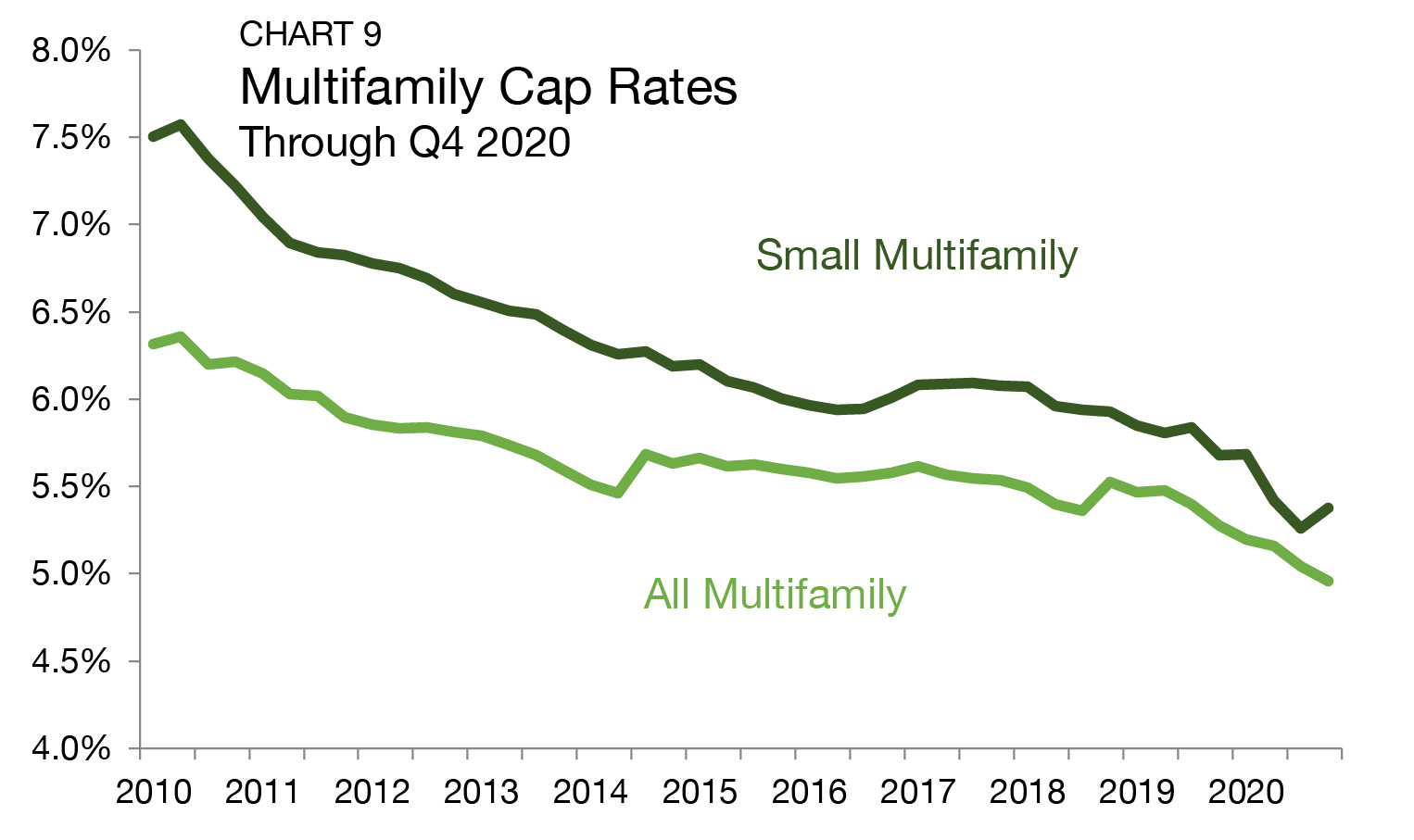

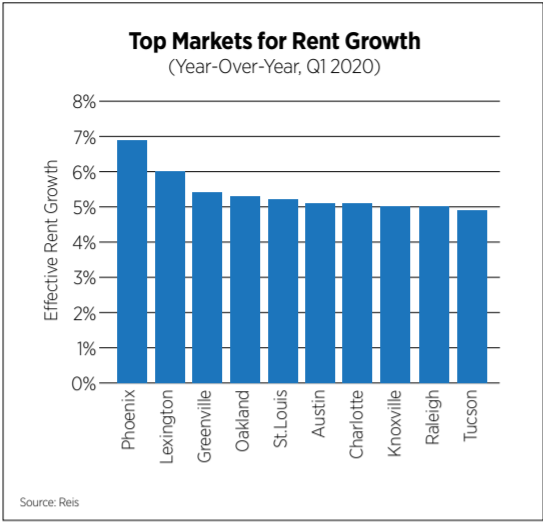

Multifamily Cap Rates 2020. Multifamily cap rates ended 2020 at 49 percent and have not received an upward boost so far in 2021. According to data from RealPage year-over-year lease renewals for class A units as of June 2020 were at 484 percent. Value Add Acquisitions are priced at an all-time high averaging a 6 cap. Because cap rates indicate a propertys potential rate of return for buyers it can be used to evaluate investment risk between multiple investment options.

Q4 2020 Small Multifamily Investment Report Arbor Realty From arbor.com

Q4 2020 Small Multifamily Investment Report Arbor Realty From arbor.com

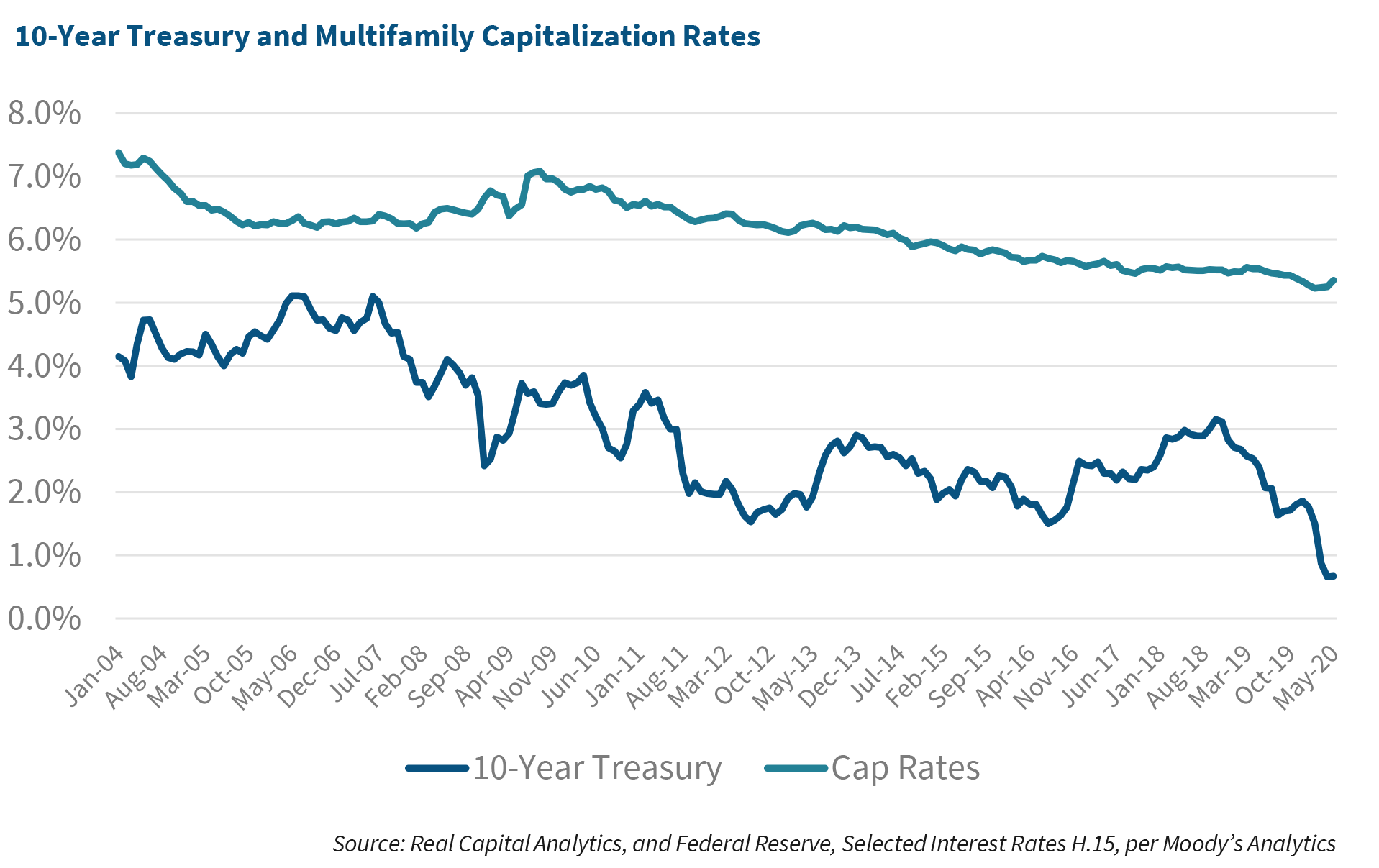

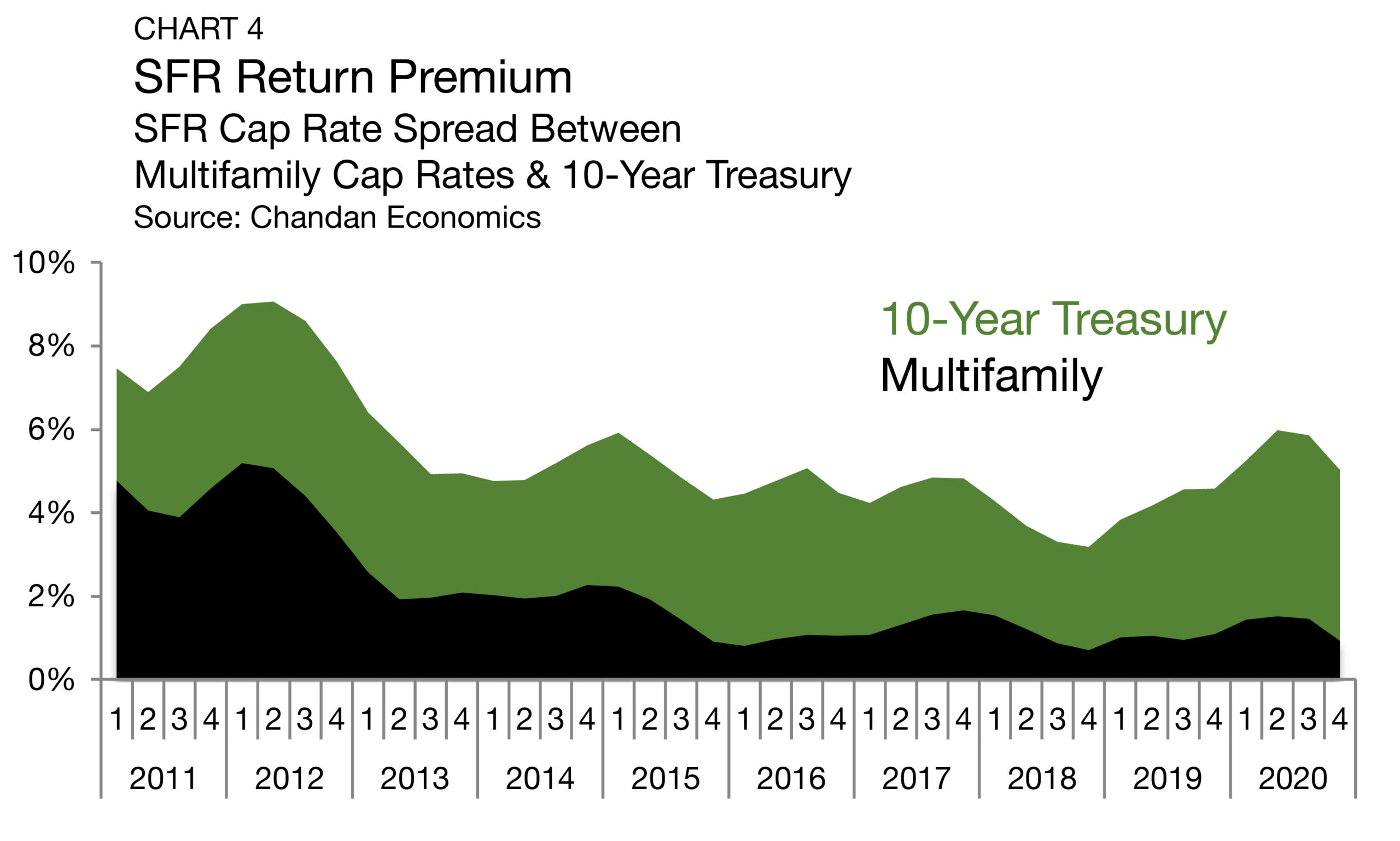

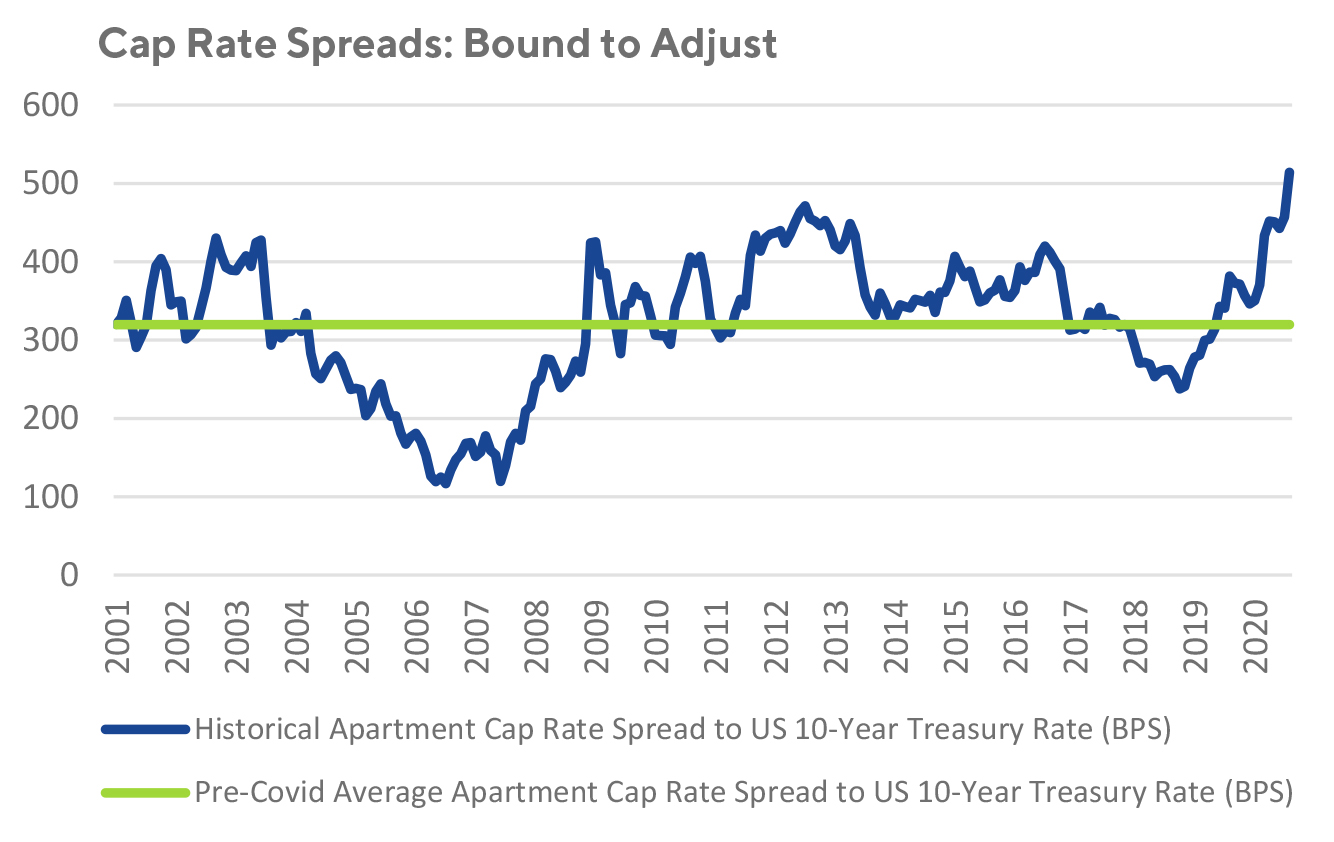

FHFA anticipates the 2021 cap levels to be appropriate given current market forecasts. 2020 year end multi-family market report 6 2020 year end multi-family market report 7 executive summary 2020 market statistics year 2020 transactions number of transactions 84 dollar volume of transactions greater vancouver victoria approx 112b rent vancouver cma avg monthly rent vacancy 1480 vancouver cma vacancy rate 11 cap rate 2. With rates less than 3 available make multifamily the preferred asset class for many investors. Real Capital Analytics SOURCES REFERENCES 2020 VIEWPOINT MULTIFAMILY REPORT INTEGRA REALTY RESOURCES CAP RATES AND VALUES Consistent with market fundamentals cap rate contraction even though rates a year ago seemed irreducibly low with risk premiums that did not compensate investors adequately. Because cap rates indicate a propertys potential rate of return for buyers it can be used to evaluate investment risk between multiple investment options. Value Add Acquisitions are priced at an all-time high averaging a 6 cap.

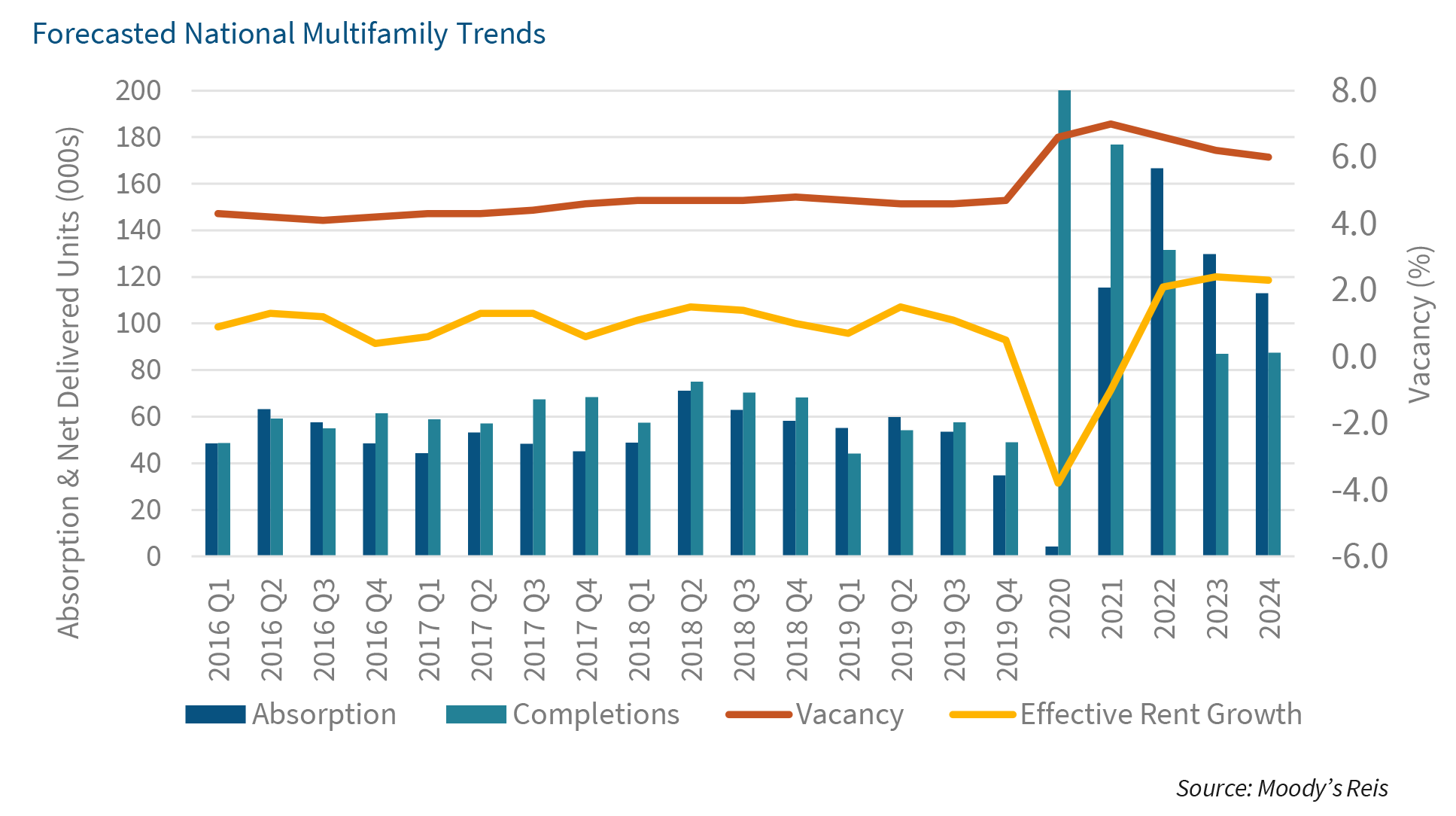

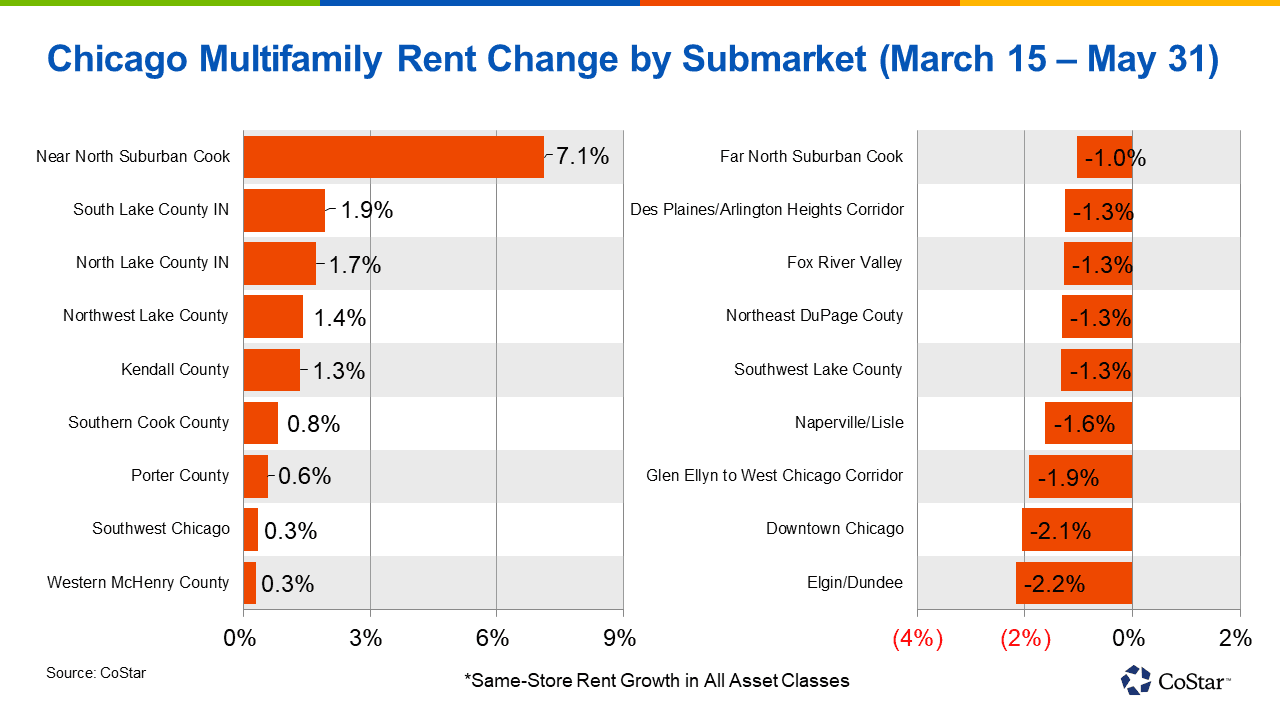

Vacancy rates up 200-250bps and rents down -12 to -17 resulting in gross income growth -33 to -42 for the year.

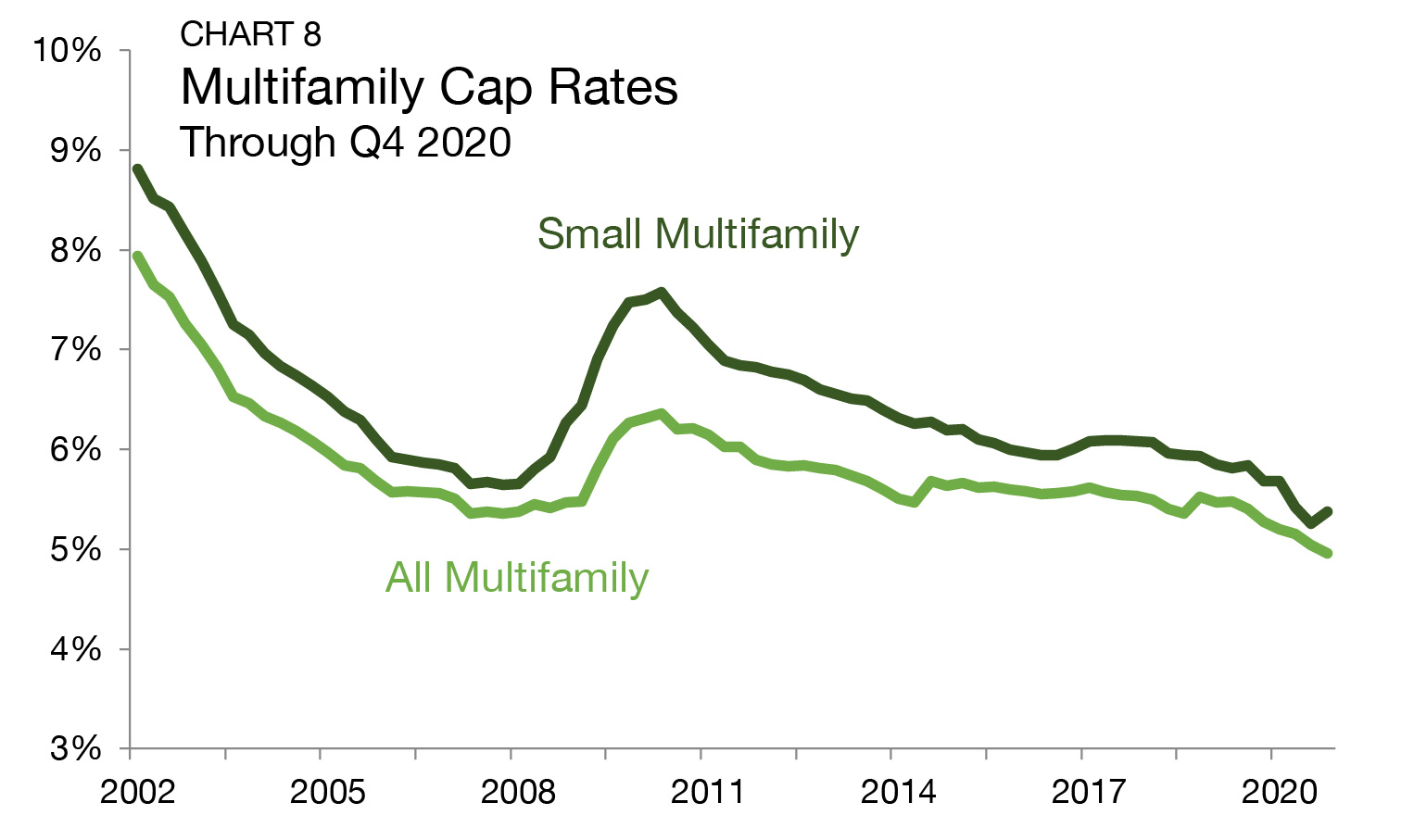

Cap Rates for Multifamily Apartment properties are holding at a historical low for 2021- averaging a 5 cap or even lower for newer A and B Class and 534 for C Class. Naples real estate market 594. Highest Multifamily Cap Rate. Cap Rate Survey Special Report 2020 CBRE. Over the last five years average multifamily cap rates have declined from about 6 to 55 through November 2019. Value Add Acquisitions are priced at an all-time high averaging a 6 cap.

Source: mortgagemedia.com

Source: mortgagemedia.com

The COVID-related decline in investment sales and disruption to net operating income for many properties have created challenges in assessing average capitalization rates. Based on current trends we believe that annual multifamily originations could easily surpass both estimates. Using Cap Rates to Examine Multifamily Real Estate Investing Risk. Honolulu real estate market 007. Cap Rates for Multifamily Apartment properties are holding at a historical low for 2021- averaging a 5 cap or even lower for newer A and B Class and 534 for C Class.

Source: pinterest.com

Source: pinterest.com

Vacancy rates up 200-250bps and rents down -12 to -17 resulting in gross income growth -33 to -42 for the year. Apartment and multifamily loan rates range from 212 for a 35 year fixed FHA loan to 379 for a 5 year fixed community bank loan. Multifamily Cap Rates by City Range. Vacancy rates up 200-250bps and rents down -12 to -17 resulting in gross income growth -33 to -42 for the year. In the middle is a 15 year fixed Fannie Mae loan at 365.

Source: 2ndkitchen.com

Source: 2ndkitchen.com

Lowest Multifamily Cap Rate. The 2021 volume caps applicable to the multifamily loan purchases of Fannie Mae and Freddie Mac the Enterprises will be 70 billion for each Enterprise for a total of 140 billion during the four-quarter period Q1 2021 Q4 2021. Using Cap Rates to Examine Multifamily Real Estate Investing Risk. From 008 to 2143. Honolulu real estate market 007.

Source: multifamily.fanniemae.com

Source: multifamily.fanniemae.com

Over the last five years average multifamily cap rates have declined from about 6 to 55 through November 2019. FHFA anticipates the 2021 cap levels to be appropriate given current market forecasts. However FHFA has been and. Cap Rate Survey Special Report 2020 CBRE. Because cap rates indicate a propertys potential rate of return for buyers it can be used to evaluate investment risk between multiple investment options.

Source: multifamily.fanniemae.com

Source: multifamily.fanniemae.com

Overall a good cap rate for multifamily investments is around 4 10. Multifamily fundamentals for 2020 are expected to weaken due to the negative effects of the virus on the economy. In recent years average cap rates have hovered in a tight range falling between 4 percent and 45 percent since 2016. According to data from RealPage year-over-year lease renewals for class A units as of June 2020 were at 484 percent. Naples real estate market 594.

Source: arbor.com

Source: arbor.com

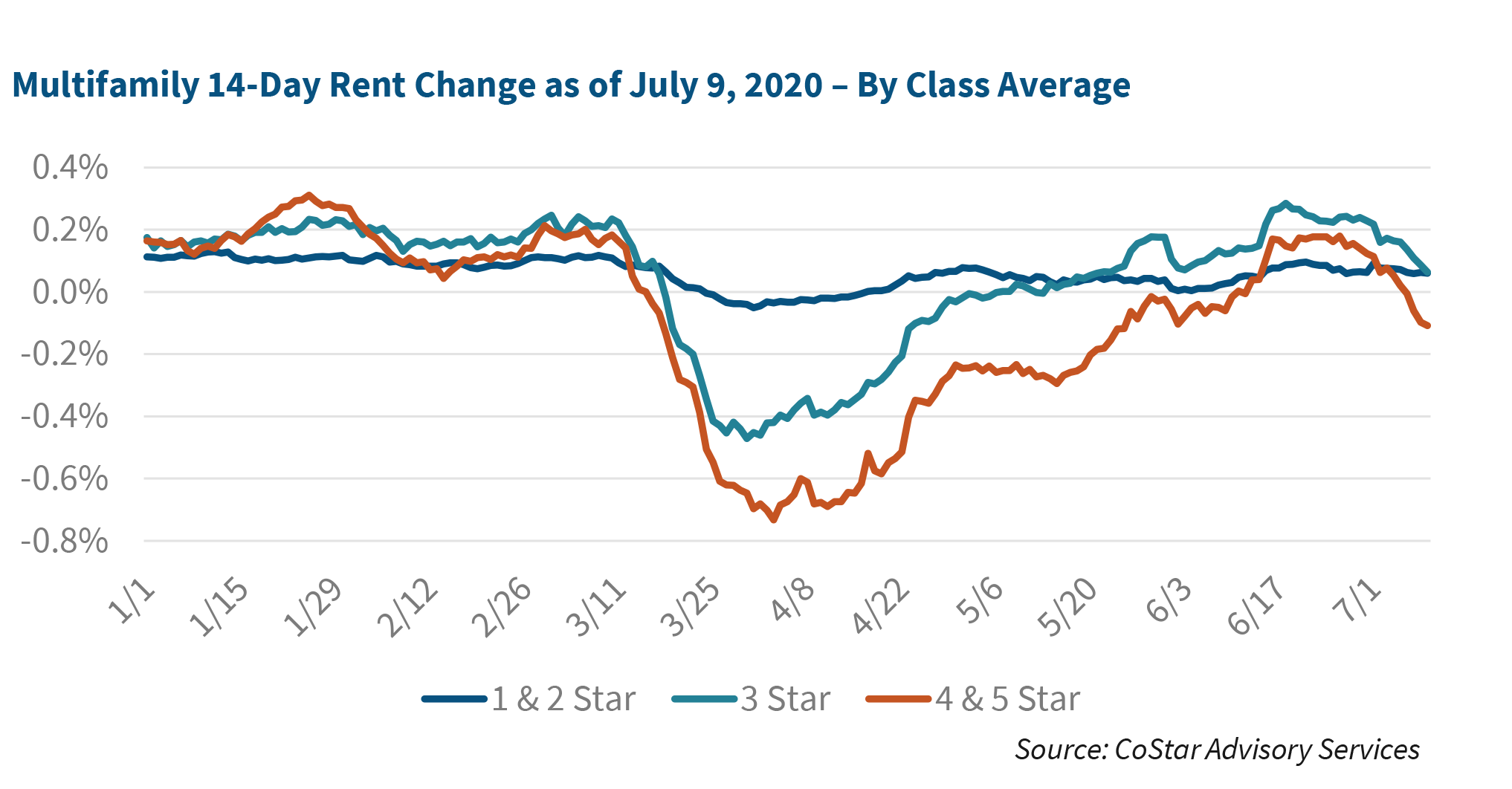

Elevated supply rent growth could moderate and vacancy rates may increase slightly in 2020. Vacancy rates up 200-250bps and rents down -12 to -17 resulting in gross income growth -33 to -42 for the year. Because cap rates indicate a propertys potential rate of return for buyers it can be used to evaluate investment risk between multiple investment options. Cap Rates for Multifamily Apartment properties are holding at a historical low for 2021- averaging a 5 cap or even lower for newer A and B Class and 534 for C Class. But for class B units the renewal rate was higher at 541 percent and even slightly higher for class C units at 582 percent.

Source: arbor.com

Source: arbor.com

Over the last five years average multifamily cap rates have declined from about 6 to 55 through November 2019. Elevated supply rent growth could moderate and vacancy rates may increase slightly in 2020. Vacancy rates up 200-250bps and rents down -12 to -17 resulting in gross income growth -33 to -42 for the year. That risk premium has expanded by. Multifamily cap rates ended 2020 at 49 percent and have not received an upward boost so far in 2021.

Source: multifamily.fanniemae.com

Source: multifamily.fanniemae.com

Because cap rates indicate a propertys potential rate of return for buyers it can be used to evaluate investment risk between multiple investment options. Cap rates for this segment of the apartment market have been rising due to competition from new supply and more onerous rent control regulations in certain markets. In the first half of 2020 there were 91 multifamily totaling 1 billion in. Multifamily properties have one of the lowest average cap rates of any property asset type due to its lower risk. The second quarter started to see demand drop vacancy rates rise and rent growth slow.

Source: altusgroup.com

Source: altusgroup.com

While the national average cap rate figure for Class B industrial properties rose by 2 bps over the quarter this was due to upwards movements in only one market Calgary which saw Class B industrial cap rates rise by 37 bps. However its not quite as simple as that. Cap Rates for Multifamily Apartment properties are holding at a historical low for 2021- averaging a 5 cap or even lower for newer A and B Class and 534 for C Class. However returns can and do change. The COVID-related decline in investment sales and disruption to net operating income for many properties have created challenges in assessing average capitalization rates.

Source: pinterest.com

Source: pinterest.com

The second quarter started to see demand drop vacancy rates rise and rent growth slow. In recent years average cap rates have hovered in a tight range falling between 4 percent and 45 percent since 2016. To best ensure accuracy hotels were excluded from this survey and retail cap rates were collected only for grocery-anchored pro. Foreclosed Homes for Sale in 2020. One of the best interest rates is from a life company at 333 for a 25 year fixed.

Source: arbor.com

Source: arbor.com

According to data from RealPage year-over-year lease renewals for class A units as of June 2020 were at 484 percent. One of the best interest rates is from a life company at 333 for a 25 year fixed. FHFA anticipates the 2021 cap levels to be appropriate given current market forecasts. In recent years average cap rates have hovered in a tight range falling between 4 percent and 45 percent since 2016. The cap rates for small multifamily properties barely budged between the first and second quarters of 2020 according to a new report by Chandan Economics and Arbor Realty Trust.

Source: cabotandcompany.com

Source: cabotandcompany.com

Department of the Treasury reports the current 10-year Treasury yield is 133. Cap Rates for Multifamily Apartment properties are holding at a historical low for 2021- averaging a 5 cap or even lower for newer A and B Class and 534 for C Class. One of the best interest rates is from a life company at 333 for a 25 year fixed. Multifamily cap rates ended 2020 at 49 percent and have not received an upward boost so far in 2021. To best ensure accuracy hotels were excluded from this survey and retail cap rates were collected only for grocery-anchored pro.

Source: naahq.org

Source: naahq.org

Multifamily properties have one of the lowest average cap rates of any property asset type due to its lower risk. But for class B units the renewal rate was higher at 541 percent and even slightly higher for class C units at 582 percent. Using Cap Rates to Examine Multifamily Real Estate Investing Risk. While the national average cap rate figure for Class B industrial properties rose by 2 bps over the quarter this was due to upwards movements in only one market Calgary which saw Class B industrial cap rates rise by 37 bps. With rates less than 3 available make multifamily the preferred asset class for many investors.

Source: pinterest.com

Source: pinterest.com

2020 year end multi-family market report 6 2020 year end multi-family market report 7 executive summary 2020 market statistics year 2020 transactions number of transactions 84 dollar volume of transactions greater vancouver victoria approx 112b rent vancouver cma avg monthly rent vacancy 1480 vancouver cma vacancy rate 11 cap rate 2. However returns can and do change. The 2021 volume caps applicable to the multifamily loan purchases of Fannie Mae and Freddie Mac the Enterprises will be 70 billion for each Enterprise for a total of 140 billion during the four-quarter period Q1 2021 Q4 2021. Cap Rates for Multifamily Apartment properties are holding at a historical low for 2021- averaging a 5 cap or even lower for newer A and B Class and 534 for C Class. 2020 year end multi-family market report 6 2020 year end multi-family market report 7 executive summary 2020 market statistics year 2020 transactions number of transactions 84 dollar volume of transactions greater vancouver victoria approx 112b rent vancouver cma avg monthly rent vacancy 1480 vancouver cma vacancy rate 11 cap rate 2.

Source: pinterest.com

Source: pinterest.com

Multifamily properties have one of the lowest average cap rates of any property asset type due to its lower risk. In the middle is a 15 year fixed Fannie Mae loan at 365. Over the last five years average multifamily cap rates have declined from about 6 to 55 through November 2019. The second quarter started to see demand drop vacancy rates rise and rent growth slow. Because cap rates indicate a propertys potential rate of return for buyers it can be used to evaluate investment risk between multiple investment options.

Source: spirecapital.com.au

Source: spirecapital.com.au

Department of the Treasury reports the current 10-year Treasury yield is 133. Cap Rate Survey Special Report 2020 CBRE. 2020 year end multi-family market report 6 2020 year end multi-family market report 7 executive summary 2020 market statistics year 2020 transactions number of transactions 84 dollar volume of transactions greater vancouver victoria approx 112b rent vancouver cma avg monthly rent vacancy 1480 vancouver cma vacancy rate 11 cap rate 2. The second quarter started to see demand drop vacancy rates rise and rent growth slow. In Q3 2020 the cap rate for mid to high-rise assets climbed ten bps from a year earlier to five percent.

Source: altusgroup.com

Source: altusgroup.com

But for class B units the renewal rate was higher at 541 percent and even slightly higher for class C units at 582 percent. In Q3 2020 the cap rate for mid to high-rise assets climbed ten bps from a year earlier to five percent. According to data from RealPage year-over-year lease renewals for class A units as of June 2020 were at 484 percent. Elevated supply rent growth could moderate and vacancy rates may increase slightly in 2020. The COVID-related decline in investment sales and disruption to net operating income for many properties have created challenges in assessing average capitalization rates.

Source: fi.pinterest.com

Source: fi.pinterest.com

The cap rate on a retail shopping center should not be used to determine the value of a multifamily property. Cap Rates for Multifamily Apartment properties are holding at a historical low for 2021- averaging a 5 cap or even lower for newer A and B Class and 534 for C Class. That risk premium has expanded by. Foreclosure Cap Rates by City Range. From 007 to 594.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title multifamily cap rates 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.