Your Pluralsight market cap bitcoin are ready in this website. Pluralsight market cap are a mining that is most popular and liked by everyone now. You can Find and Download the Pluralsight market cap files here. Find and Download all free trading.

If you’re looking for pluralsight market cap pictures information linked to the pluralsight market cap topic, you have come to the ideal blog. Our website always gives you hints for downloading the maximum quality video and image content, please kindly surf and locate more informative video content and images that fit your interests.

Pluralsight Market Cap. Stock Unknown Not Listed. Current and historical revenue charts for Pluralsight. Class A Common Stock. The largest stake in Pluralsight Inc.

Document From sec.gov

Document From sec.gov

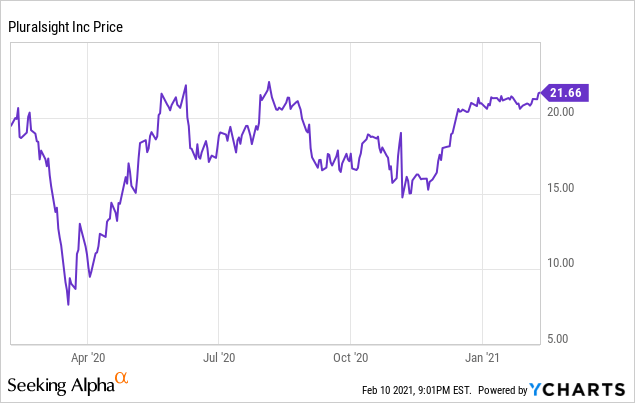

Competitive companies are chosen from companies within the same industry with headquarter located in same country with closest market capitalization. With present share price near 21 Pluralsights market cap is 307 billion and after netting off the 5287 million of cash and 4835 million of debt on Pluralsights balance sheet its. For the Software - Application subindustry Pluralsights Peter Lynch Fair Value along with its competitors market caps and Peter Lynch Fair Value data can be viewed below. Pluralsight shareholder rejects Vista Equitys revised offer. 5606 total market cap. On May 7 the company said it estimated it would price shares between 10 and 12 each.

The largest stake in Pluralsight Inc.

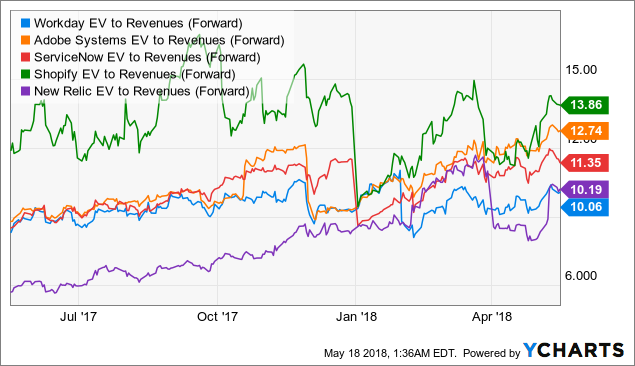

And despite these merits Pluralsight trades very cheaply relative to other enterprise software peers. 5541 total market cap. Shares in Pluralsight Inc are currently trading at 2245 giving the company a market capitalisation of na. Pluralsight PS shareholder Eminence Capital which owns a 484 stake encourages other holders to reject the revised merger offer from Vista Equity PartnersVistas modestly improved offer for Pluralsight from an. Expert-led courses for developers IT professionals. As of November 2021 Pluralsight s TTM revenue is of 039 B companies.

Source: sec.gov

Source: sec.gov

Pluralsight Pluralsight Inc. It was followed by D E. On May 7 the company said it estimated it would price shares between 10 and 12 each. Current and historical earnings charts for Pluralsight. Ad On-demand training made simple.

Source: jkresearch.com

Source: jkresearch.com

The company earns -11266 million in net income profit each year or 098 on an earnings per share basis. Expert-led courses for developers IT professionals. Pluralsight market cap is 33 b and annual revenue was 16682 m in FY 2017. Additionally PS Total Debt to Total Capital is recorded at 7269 with Total Debt to Total Assets ending up at 4721. Class A Common Stock.

Source: seekingalpha.com

Source: seekingalpha.com

Free 10-day trial - Start today. 5541 total market cap. 1 training for individuals and businesses. Is Pluralsight Inc. 39187M -15267M-116-1940.

Pluralsight PS stock price revenue and financials. As of November 2021 Pluralsight s TTM earnings are -014 B companies. There are presently around 2098 million in the hands of institutional investors. Pluralsight Pluralsight Inc. It was followed by D E.

Source: pluralsight.com

Source: pluralsight.com

Pluralsight shareholder rejects Vista Equitys revised offer. Ad On-demand training made simple. It was followed by D E. 5606 total market cap. Class A Common Stock.

Source: seekingalpha.com

Source: seekingalpha.com

Class A Common Stock. As of November 2021 Pluralsight s TTM earnings are -014 B companies. When it comes to the capital structure of this company Pluralsight Inc. The bigger the dot. 5541 total market cap.

Source: forbes.com

Source: forbes.com

Pluralsight has raised its IPO pricing range to 12-14 per share indicating an opening market cap of 171 billion at the midpoint. Pluralsight market cap is 33 b and annual revenue was 16682 m in FY 2017. Free 10-day trial - Start today. This group of stocks market caps are closest to PSs market cap. Ad On-demand training made simple.

Source: seekingalpha.com

Source: seekingalpha.com

The company stock closed on Friday at 1850 per share on a market cap of over 27 billion. Table Ticker No of HFs with positions Total Value of HF Positions x1000 Change in HF. Pluralsight has raised its IPO pricing range to 12-14 per share indicating an opening market cap of 171 billion at the midpoint. Free 10-day trial - Start today. X-axis shows the market cap and y-axis shows the term.

Source: seekingalpha.com

Source: seekingalpha.com

Return on Equity for this stock declined to -7922 with Return on Assets sitting at -1523. It was followed by D E. For the Software - Application subindustry Pluralsights Gross Margin along with its competitors market caps and Gross Margin data can be viewed below. NASDAQPS was held by Zevenbergen Capital Investments which reported holding 212 million worth of stock at the end of September. The company earns -11266 million in net income profit each year or 098 on an earnings per share basis.

Source: blockchainara.com

Source: blockchainara.com

On May 7 the company said it estimated it would price shares between 10 and 12 each. 5606 total market cap. 1 training for individuals and businesses. With present share price near 21 Pluralsights market cap is 307 billion and after netting off the 5287 million of cash and 4835 million of debt on Pluralsights balance sheet its. With Pluralsight Vista gets an online Vista acquires IT education platform Pluralsight for 35B.

Source: seekingalpha.com

Source: seekingalpha.com

Pluralsight Pluralsight Inc. Expert-led courses for developers IT professionals. Shares in Pluralsight Inc are currently trading at 2245 giving the company a market capitalisation of na. 1 training for individuals and businesses. Where are Pluralsight Inc shares listed.

Source: sec.gov

Source: sec.gov

Competitive companies are chosen from companies within the same industry with headquarter located in same country with closest market capitalization. For the Software - Application subindustry Pluralsights Peter Lynch Fair Value along with its competitors market caps and Peter Lynch Fair Value data can be viewed below. 5541 total market cap. The company stock closed on Friday at 1850 per share on a market cap of over 27 billion. FMR LLC with ownership of 16320897 which is approximately 18271 of the companys market cap and around 110 of the total institutional ownership.

Source: seekingalpha.com

Source: seekingalpha.com

Current and historical revenue charts for Pluralsight. As of November 2021 Pluralsight s TTM revenue is of 039 B companies. Pluralsight PS shareholder Eminence Capital which owns a 484 stake encourages other holders to reject the revised merger offer from Vista Equity PartnersVistas modestly improved offer for Pluralsight from an. Pluralsight first filed to go public on April 16. The company stock closed on Friday at 1850 per share on a market cap of over 27 billion.

FMR LLC with ownership of 16320897 which is approximately 18271 of the companys market cap and around 110 of the total institutional ownership. What is the market cap of Pluralsight Inc. Ad On-demand training made simple. For the Software - Application subindustry Pluralsights Peter Lynch Fair Value along with its competitors market caps and Peter Lynch Fair Value data can be viewed below. PS has a Total Debt to Total Equity ratio set at 26622.

Source: fool.com

Source: fool.com

Class A Common Stock. 5606 total market cap. Additionally PS Total Debt to Total Capital is recorded at 7269 with Total Debt to Total Assets ending up at 4721. Where are Pluralsight Inc shares listed. Market Outlet Security Exchange Symbol Type.

Source: companiesmarketcap.com

Source: companiesmarketcap.com

X-axis shows the market cap and y-axis shows the term value. As of November 2021 Pluralsight s TTM earnings are -014 B companies. PS has a Total Debt to Total Equity ratio set at 26622. With present share price near 21 Pluralsights market cap is 307 billion and after netting off the 5287 million of cash and 4835 million of debt on Pluralsights balance sheet its. Pluralsight shareholder rejects Vista Equitys revised offer.

Source: sec.gov

Source: sec.gov

Pluralsight has a market capitalization of 333 billion and generates 31691 million in revenue each year. 1 training for individuals and businesses. Shares in Pluralsight Inc are currently trading at 2245 giving the company a market capitalisation of na. Where are Pluralsight Inc shares listed. The bigger the dot.

The company earns -11266 million in net income profit each year or 098 on an earnings per share basis. For the Software - Application subindustry Pluralsights Peter Lynch Fair Value along with its competitors market caps and Peter Lynch Fair Value data can be viewed below. X-axis shows the market cap and y-axis shows the term. Pluralsight shareholder rejects Vista Equitys revised offer. Table Ticker No of HFs with positions Total Value of HF Positions x1000 Change in HF.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title pluralsight market cap by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.